To avail of a business loan for women from Kinara, you can apply online by visiting our website or downloading the myKinara app . You can complete the 1-minute eligibility check to get started. Once your eligibility check is complete, you can upload your documents to take the application forward on the site or using the app. Alternatively, a Kinara loan officer will get in touch with you as soon as possible to complete the rest of the formalities, after which it can take as little as 24 hours for your loan to be approved and disbursed right into your account.

Supporting Dreams of Women Entrepreneurs

Discounted business loans for women-owned MSMEs to help them take their businesses to the next level, with no additional documentation required.

-

Tenure

12 to 60

months -

Rates

Starts at 24%On a reducing rate basis

Why choose Kinara Capital?

Get MSME loans from ₹1 lakh to ₹30 lakhs with a digital-first process in your preferred language. We serve 4,500+ pincodes and 300+ sectors.

Fast

Get your loan in 24 hours

Flexible

Minimal and flexible documentation process

Friendly

Doorstep customer service to help you from start to finish

Grow your business

with our support

Working Capital Loans

Business loans for all of your day-to-day expenses and to seize opportunities for growth.

-

Stock Purchase

-

Business Space Renovation

-

General Business Expenses

-

Machine Repair

-

Market Expansion

Asset Purchase Loans

Increase your business efficiency by purchasing new or second-hand equipment and machinery.

-

New Machine Purchase

-

Second-hand Machine Purchase

Loans for all MSMEs

Women business owners engaged in any sector can avail of the discount under HerVikas.

Hear from our Happy Customers

Meet our VikasChampions

With their grit & perseverance, small business owners go on to create local jobs and grow India’s economy. Here’s what they have to say about us!

Sivachandra R.

Sri Aarusuvai Food Products

“We took the loan and two subsequent ones from Kinara for buying machinery, which have been very helpful in running our business successfully”

Read Full Story

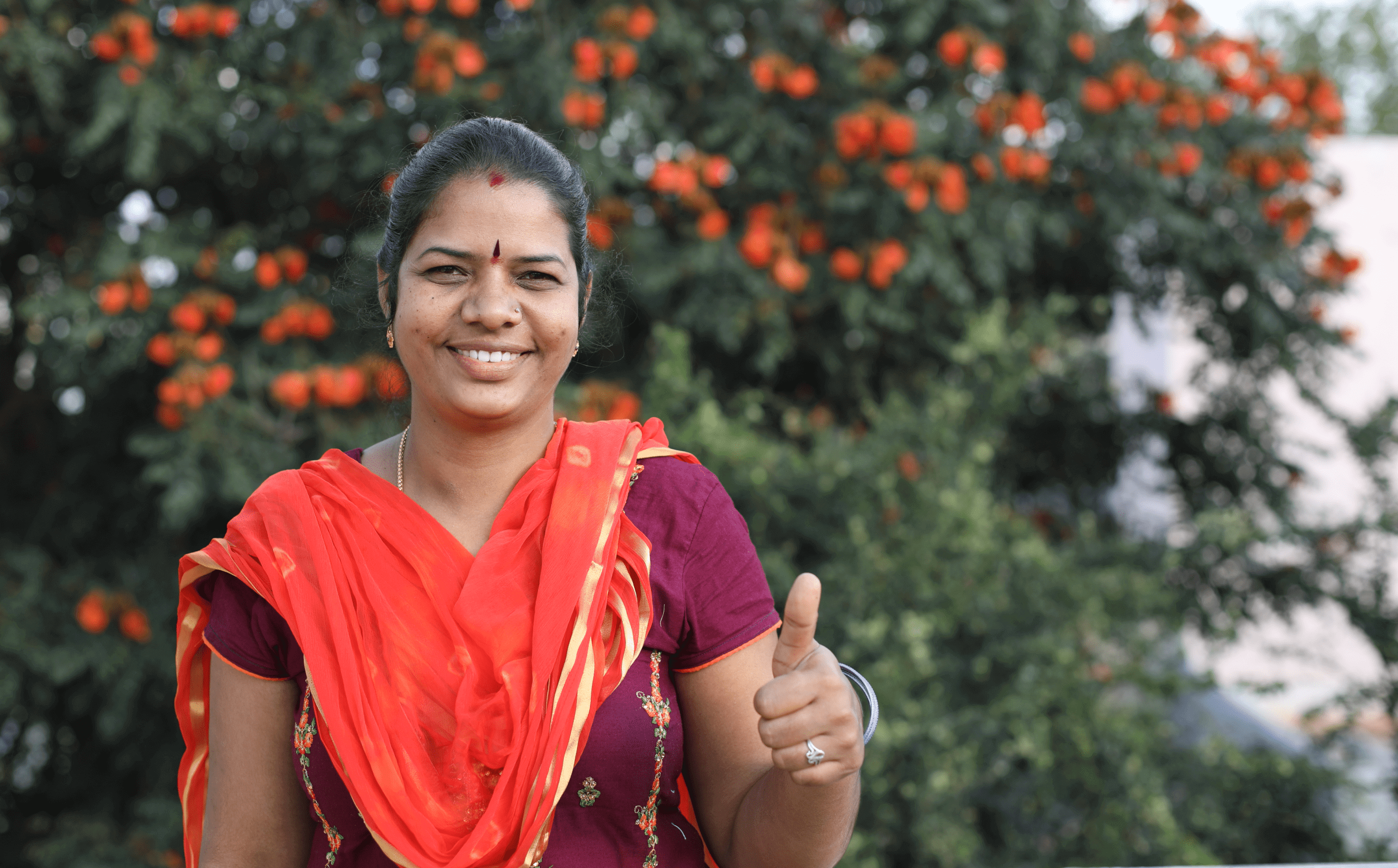

Shyamala

V.V. Creation

“Women cannot be limited to the confines of a household. We can pursue any dream we have with the help of supporters like Kinara Capital"

Read Full Story

Anupama Chenna

Sri Padmavathi Enterprises

"Since we got our first loan from Kinara, business has improved, increasing our turnover to Rs. 15 lakhs from Rs. 1-2 lakhs in 8 months.”

Read Full Story

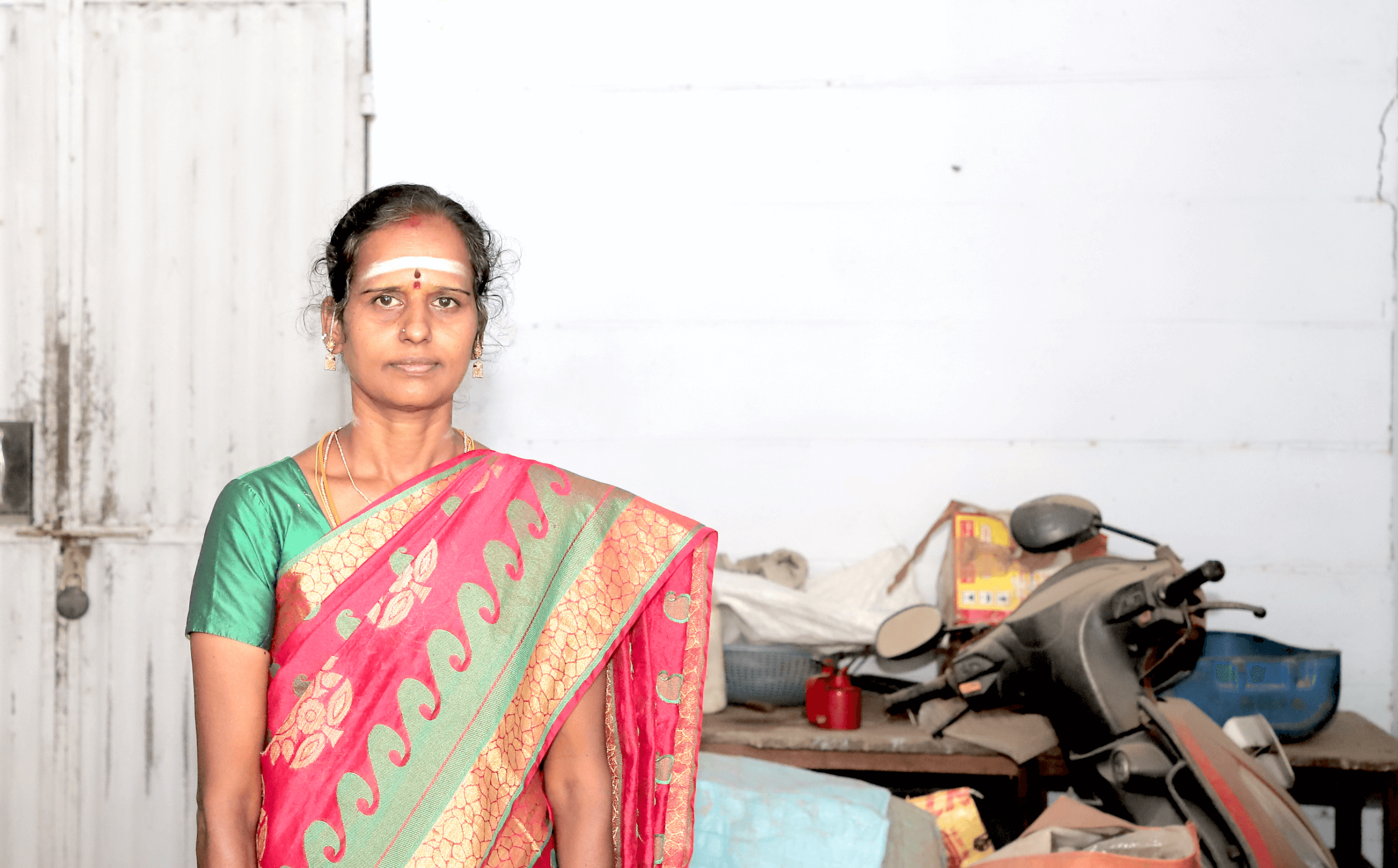

M Banu

KMB Metal Works

“With two collateral-free loans from Kinara capital, we were able to buy machinery and increase our turnover by five times to Rs. 1.5 lakhs.”

Read Full Story

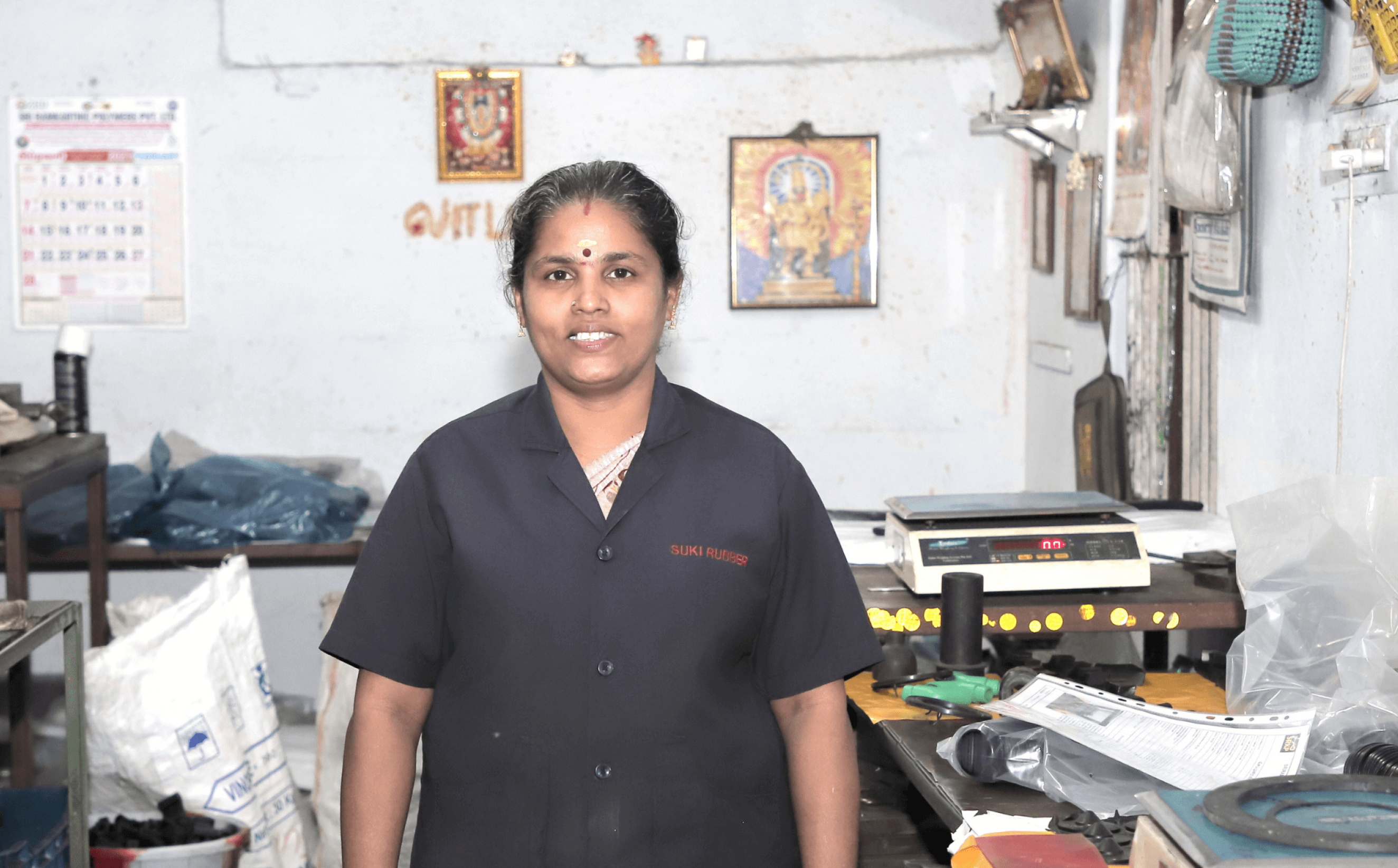

A.Geetha

Suki Rubber Products

“Kinara has supported me throughout. When I paid off my first loan, I was able to apply for another one and keep growing my business.”

Read Full Story

Mahalakshmi

Fancy And Tailoring Store

"Initially I was a bit skeptical, but the Kinara officer reassured me, and we got the loan within 3 days. Now I’m a HerVikas businesswoman!"

Read Full Story

Fatima Bai

Al Shams Enterprises

"Initially I was skeptical about the loan from Kinara, but we ended up getting the amount in just 3 days! Now I’m a HerVikas businesswoman!"

Read Full Story

Business Loans for Women

Women entrepreneurs in India need capital in order to improve and expand their businesses, just like their male counterparts. However, due to accessibility issues and systemic biases, they have a much more difficult time when it comes to applying and being approved for business loans. To bridge this gap Kinara Capital offers special collateral-free loans for women under the HerVikas scheme. The loan scheme is reserved for women entrepreneurs engaged in the MSME sector, and offers an upfront discount on loans for women.

With this additional boost, women entrepreneurs can seize the same opportunities as their male counterparts with minimal hassle to access financing. A major advantage of women finding their feet through entrepreneurship is that it affects a positive multi-generational shift. Women business owners also create job opportunities for other women, therefore improving the lives and livelihoods of many individuals and families.

Eligibility Criteria for a business loan for Women

The eligibility criteria for collateral-free business loans for women is no different from those for other loans issued by Kinara. The following are the criteria you need to meet in order to be eligible:

• Your business should be fully or partially owned and run by a women entrepreneur.

• Your business should be an MSME operating in the manufacturing, trading, or services sector.

• The business should be in operation for more than 2 years at the time of application.

• The total monthly turnover should be greater than Rs. 50,000 and less than Rs. 2 crores.

• The business should be a sole proprietorship, partnership or private limited company.

• Both an applicant and co-applicant are needed in order to apply for a loan.

Benefits of Business Loan for Women

Women entrepreneurs need specialized loan products that level the playing field by giving them equal access to capital, as well as additional advantages. Business loans for women from Kinara have various benefits for women entrepreneurs, including:

• HerVikas collateral-free loans for women entrepreneurs have the added advantage of an upfront discount of up to 1% on any category of loan.

• MSMEs don't have to promise any collateral for these loans for women.

• The Kinara team ensures an unbiased process and loan approval is not based on gender identity.

• You can avail of a loan of up to Rs. 30 lakhs within 24 hours.

Business loan for Women Interest Rates

Interest rate is an important consideration when it comes to availing of loans. HerVikas women business loans have the added advantage of an upfront discount of up to 1%. The interest rates start at 24% per annum and are calculated on a reducing rate basis. Being calculated on a reducing rate basis means that your EMIs will reduce over time, as the outstanding amount becomes smaller with each repayment.

Features of Kinara Capital loan for Women

Kinara Capital’s special HerVikas loans for women are designed to support women entrepreneurs and have features aimed at making the loan process fast and flexible, as well as delivering the best outcomes for the business owner:

• A Kinara Capital collateral-free business loan for women is fast, flexible, and issued without the need to submit any security or collateral.

• The application process for HerVikas loans for women from Kinara is quick and easy, and can be completed either by the women entrepreneurs themselves, or with the help of a Kinara representative.

• The process can be completed online through Kinara’s website or myKinara app.

• Having a Kinara representative come to your doorstep means that you need not travel long distances or wait in line to apply for your loan.

• HerVikas loans from Kinara require minimal documentation, and allow for the flexibility to substitute certain documents for others, based on availability.

• A HerVikas loan for women can be disbursed in as little as 24 hours, and has the added advantage of an upfront discount of up to 1%.

How to Apply for Kinara Capital Loan for Women

You can apply for collateral-free business loans for women online with a 1-minute eligibility check. If eligible, you can take the application forward by uploading your documents. Alternatively, a Kinara loan officer will get in touch with you as soon as possible to complete the rest of the requirements in your preferred language. Now you can also download the myKinara app and take the eligibility check on it. If you qualify, you can complete the application process using the app.

Why should you Buy Business Loan for Women from Kinara Capital?

Kinara makes it easy for women entrepreneurs to get a business loan. We realize that seeking loans for women entrepreneurs presents many barriers and cultural biases. Only 14% of businesses in India are owned by women; with loans like HerVikas we are challenging the status quo and enabling growth for them.

Documents Requirement for a business loan for Women

Kinara requires minimal documentation for issuing collateral-free loans to small business entrepreneurs. To make the process smooth and easy for women entrepreneurs, no special documentation or paperwork is required for the loan application process. The documents required to avail of a collateral-free business loan for women are the same as those required to apply for other loan categories:

• Applicant’s KYC document (PAN card)

• Co-applicant’s KYC document (PAN and Aadhaar are recommended, but not mandatory)

• Business KYC document (Udyam registration, etc.)

• Last 12 months’ bank statements

• GST and ITR documents are optional

FAQ

-

How to get Business loan for women?

-

How to check for Business loan for women status on Kinara Capital?

It becomes imperative to check loan status when your application gets stuck at one of the many stages of loan processing that traditional lenders suffer various hold-ups at. Kinara Capital has a 24-hour turnaround time from loan approval to disbursal, so you will not need to check the status of your loan. If your loan is approved, the processing will be smooth and extremely quick, with no systemic hold-ups.

-

What are the documents required to get a business loan for women?

The documentation requirements for HerVikas loans are the same as those for other loan categories, and no special paperwork is required. To apply for HerVikas women business loan from Kinara Capital, you will need the following documents:

• Applicant’s KYC document (PAN card)

• Co-applicant’s KYC document (PAN and Aadhaar are recommended, but not mandatory)

• Business KYC document (Udyam registration, etc.)

• Last 12 months’ bank statements

• GST and ITR documents are optional -

What is the eligibility criteria for loan for women?

If you are a woman entrepreneur who owns or co-owns an MSME, you can apply for a HerVikas, quick business loan for women. The rest of the eligibility criteria are the same as those for the rest of Kinara’s loan products:

• Your business should be an MSME operating in the manufacturing, trading, or services sector.

• The business should be in operation for more than 2 years at the time of application.

• The total monthly turnover should be greater than Rs. 50,000 and less than Rs. 2 crores.

• The business should be a sole proprietorship, partnership or private limited company.

• Both an applicant and co-applicant are needed in order to apply for a loan.

• The applicant should be between the ages of 25 and 65 to be eligible.