Why choose Kinara Capital?

Get MSME loans from ₹1 lakh to ₹30 lakhs with a digital-first process in your preferred language. We serve 4,500+ pincodes and 300+ sectors.

Fast

Get your loan in 24 hours

Flexible

Minimal and flexible documentation process

Friendly

Doorstep customer service to help you from start to finish

Collateral-free MSME Loans

We provide doorstep customer service in Mumbai and our loan process requires minimum documentation. Our fully digital process can provide you a loan within 24-hours.

-

Tenure

12 to 60 months

-

Rates

Starts at 24%On a reducing rate basis

-

1-30 lakhs

Unsecured loans in Mumbai

Mumbai is a thriving city with a multitude of business opportunities. It is one of India’s largest cities in terms of population, and is also considered the commercial capital of the country. From Andheri and Kurla to Mahape and Thane, there are thousands of small businesses, from shops to restaurants and service centres. Many small business entrepreneurs start their journey in Mumbai because of the many opportunities available. As a result, many are on the lookout to get a business loan in Mumbai. There are a lot of loan providers in Mumbai, but most of them are likely to be averse to lending to small businesses. To avail of easy collateral-free business loans in Mumbai, small business entrepreneurs can turn to Kinara Capital.

Business Loan in Maharashtra

The six most important industries in the state are cotton textiles, chemicals, machinery, electricals, transport, and metal works. From Kolhapur and Sangli to Ichalkaranji and Nashik, there are many industrial and commercial hubs across the state. Kolhapur is best known for the production of the signature Kolhapuri footwear, while Pune is the largest auto hub of India. There are many provisions for availing of a business loan in Maharashtra, from banks and NBFCs to private lenders. But getting an SME loan in Maharashtra might be a challenge, given that most lenders are keen on bigger companies than small factories. But NBFCs like Kinara Capital can solve this problem by offering small business entrepreneurs access to capital through collateral-free loans.

How to get a business loan in Mumbai?

If you want to secure a business loan in Mumbai and grow your existing business, Kinara Capital is here to help you. We provide Collateral-free business loans to MSMEs. Fill out our 1-minute eligibility check and if you are eligible, a loan officer will get in touch with you to complete the remaining formalities. The MSME loan process at Kinara Capital is hassle-free and requires limited documentation.

MSME loans for business growth

A small business might benefit from an MSME business loan by enabling the owner to buy inventory without waiting for cash flow. MSMEs can also apply for MSME loans to fund their day-to-day operations. As mentioned, MSME loan eligibility is simple, and we do not have lengthy procedures that waste your time.

Hear from our Happy Customers

Meet our VikasChampions

With their grit & perseverance, small business owners go on to create local jobs and grow India’s economy. Here’s what they have to say about us!

Vaishnavi

GainUp Designs

“Nobody was interested in giving us a loan in the early stages of the business except for Kinara. With the loan, we bought an imported machine, which helped us get new buyers and exporters and establish ourselves in our field.”

Karthikeyan AS

ASK Three Star Steels

“We got the funding from Kinara to install a powder coating unit, which triple our turnover from Rs. 1 to Rs. 3 crores a year!”

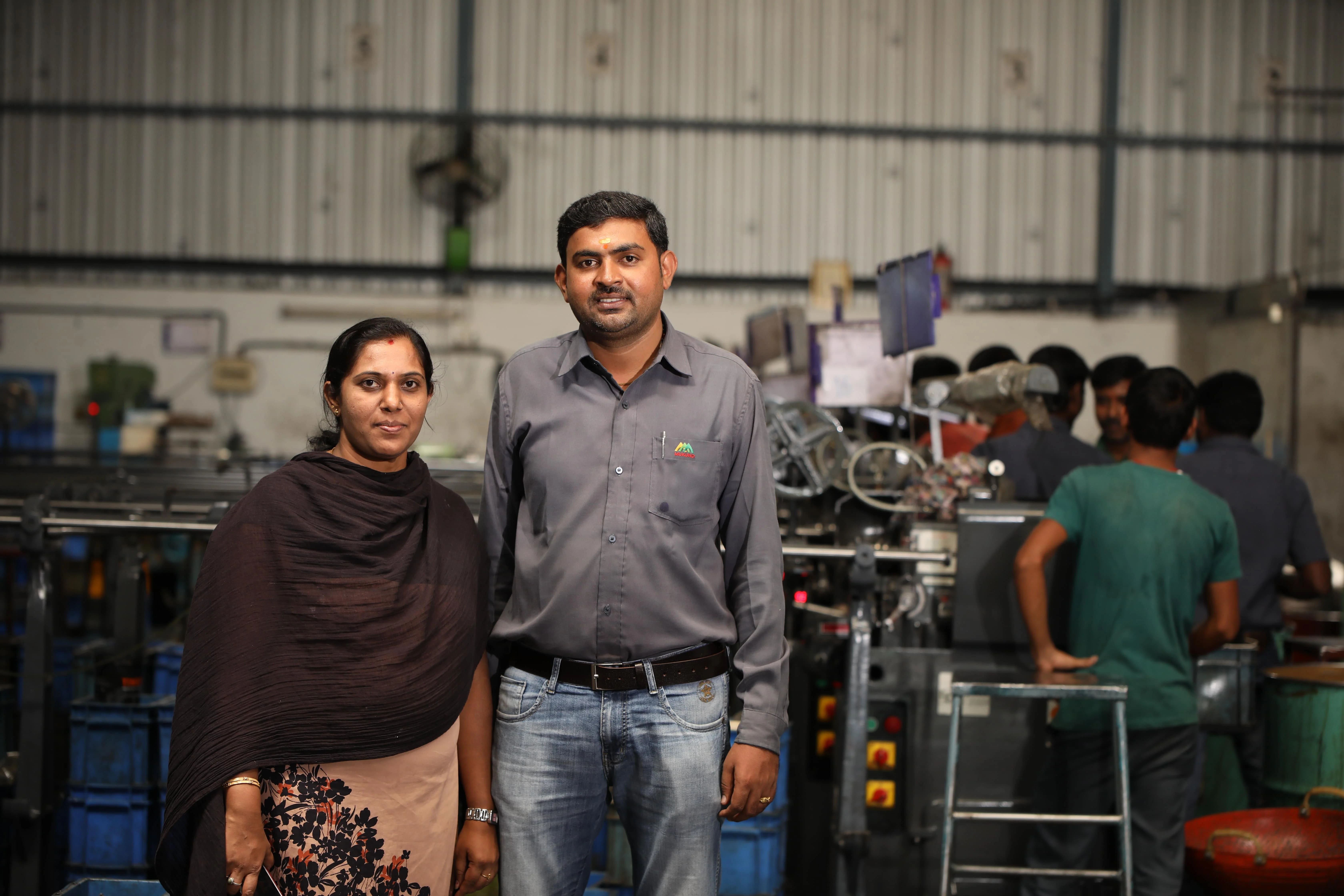

Iswarya and Mohan Babu

Mukund Automats

“After we got the first loan, we kept growing, and our workforce expanded to 50! Kinara has been the most important factor in our success.”

Amar Singh

Sai Balaji Electronics

“Kinara is like my best friend. With their support I have doubled my turnover and improved my life.”