GST inclusive amount refers to the total price of the product or service after including the GST amount in the original value of the product or service in question. The tax is not charged separately to the customer.

Why choose Kinara Capital?

Get MSME loans from ₹1 lakh to ₹30 lakhs with a digital-first process in your preferred language. We serve 4,500+ pincodes and 300+ sectors.

Fast

Get your loan in 24 hours

Flexible

Minimal and flexible documentation process

friendly

Doorstep customer service to help you from start to finish

Calculate your GST amount under

different tax slabs

Our GST calculator can help you figure out your Goods and Services Tax liability within seconds! Simply enter the details of your business and turnover and arrive at the GST amount you owe. Here’s your simple solution to making a timely and error-free tax payment.

-

Tenure

12 to 60 months

-

Rates

Starts at 24%On a reducing rate basis

-

Amount

1-30 lakhs

GST calculator

₹0

₹50,00,000

Gross Price

₹0.00

CGST Amount

₹0.00

IGST Amount

₹0.00

Total Tax

₹0.00

What is GST? And how is it calculated?

The Goods and Services Tax (GST) is a comprehensive, multi-stage tax system that is applied to the sale of goods and services across India. GST replaced all other indirect taxes, and the main aim of this system is to simplify the taxation process for businesses. Under the GST regime, tax is levied at every point of sale. In the case of intra-state sales, Central GST (CGST) and State GST (SGST) are charged. For all the inter-state sales, taxes are chargeable to the Integrated GST (IGST).

Tax calculation under GST system and types of GST

GST is charged at various slab rates depending on the nature of the goods or services. This ranges from certain essentials which are exempt, followed by tax rates of 5%, 12%, 18% and up to 28% on luxury goods. The formula for calculating GST is the taxable amount multiplied by the GST slab rate applicable to the item or service in question. GST can be calculated by multiplying the taxable amount with the GST rate applicable to the item or service. If CGST and SGST are to be applied to the transaction, each accounts for half of the GST amount. Under the GST regime, tax is levied at every point of sale. In the case of intra-state sales, Central GST (CGST) and State GST (SGST) are charged. For all the inter-state sales, taxes are chargeable to the Integrated GST (IGST).

GST calculation for retailers and wholesalers

Retailers and wholesalers were brought under the ambit of GST in a bid to formalize their transactions and minimize tax evasion through unregistered monetary exchanges. With the new GST rules on the wholesale and retail industry, every invoice with taxable supply has to be uploaded on the GSTN portal. It needs to be accepted by the buyer, retailers and wholesalers, thereby reducing tax evasion. Retailers and wholesalers can use the following formulae to calculate their GST liability:

For GST excluded amount: GST = (value of product or service * GST%)/10

For GST included amount: GST = value of product or service – [value of product/service * {100/(100+GST%)}]

Why should you get GST certification?

According to the GST mandate, it is compulsory for a business that has a turnover of more than Rs. 40 lakhs to register as a normal taxable entity. But registering your business and getting a GST identification number or GSTIN also has the following benefits:

● The amount of sales tax you are required to pay may be reduced, because you only need to pay for the added value provided by your company.

● The GSTIN is a symbol of legitimacy. It contributes to your brand identity and can help you secure funding and orders for your business.

● GST is a consolidated tax regime, which means you have to file only one return, minimizing the possibility of error, omission or scrutiny.

● GST has special provisions for e-commerce brands and inter-state movement of goods, which can make your operations smoother.

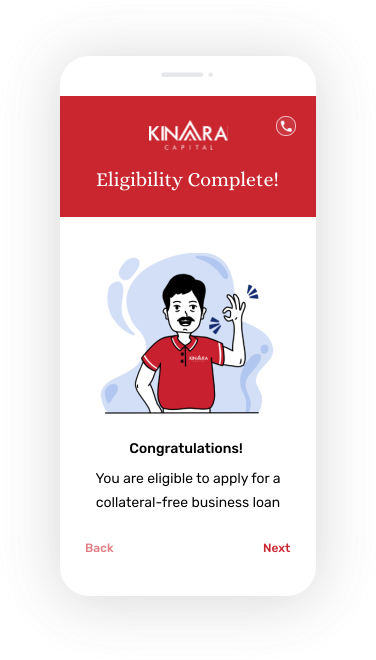

Our Process

Get a business loan in

3 easy steps!

All you have to do is enter a few details and upload your documents to our secure online portal. We’ll take care of the rest!

-

-

Fast eligibility check

Find out if your business is eligible in just 1 minute! Available in 7 languages. Zero document upload required for eligibility check.

-

Secure KYC & income verification

Provide your personal & business documents. Fully secure online portal with easy upload. Help is at your fingertips with chat or call.

-

Quick loan disbursement

Get money in your account within 24 hours! Digital loan approval with electronic bank deposit.

-

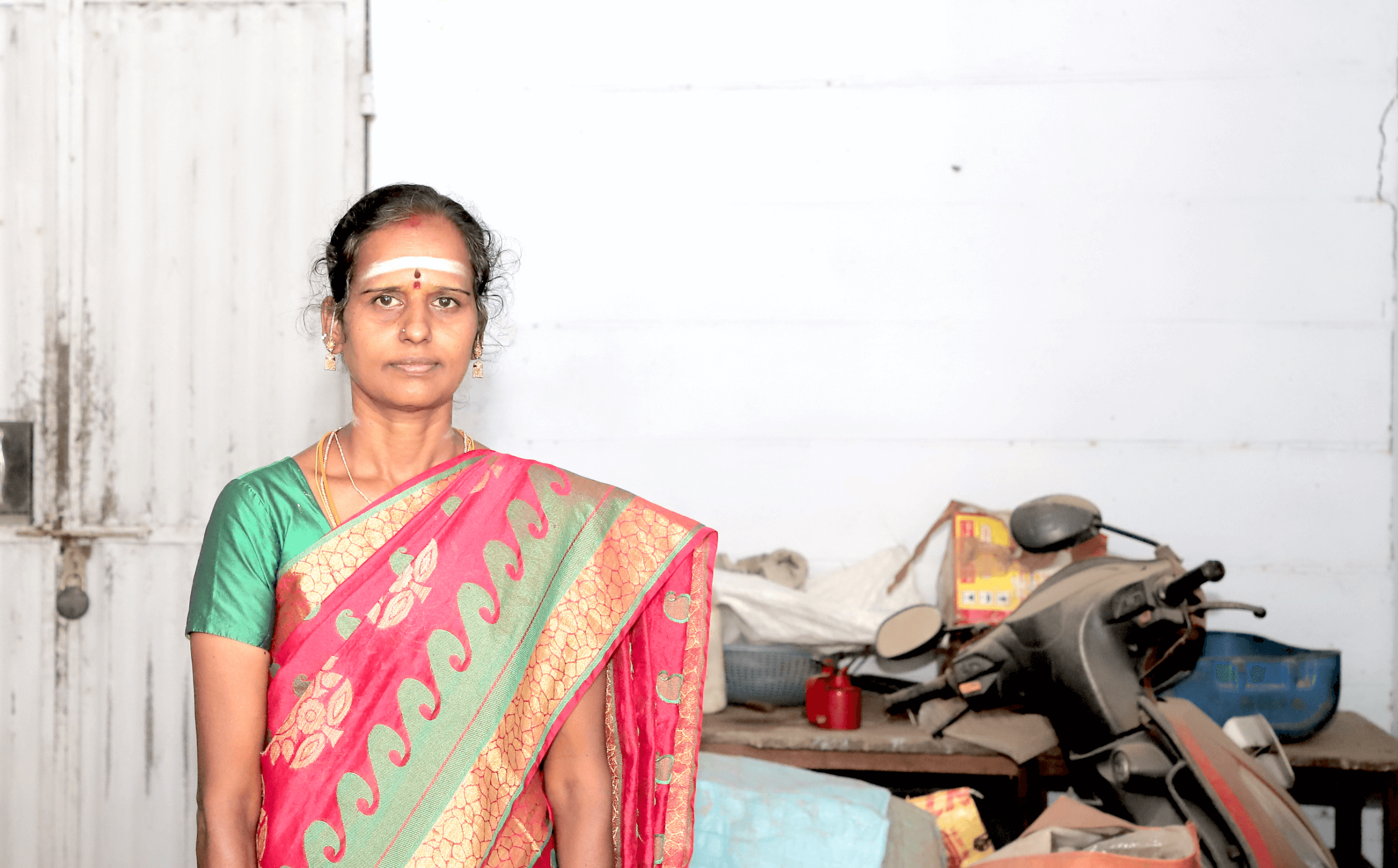

Hear from our Happy Customers

Meet our VikasChampions

With their grit & perseverance, small business owners go on to create local jobs and grow India’s economy. Here’s what they have to say about us!

Anupama Chenna

Sri Padmavathi Enterprises Gajuwaka

"Since we got our first loan from Kinara, business has improved, increasing our turnover to Rs. 15 lakhs from Rs. 1-2 lakhs in 8 months.”

M Banu

KMB Metal Works

“With two collateral-free loans from Kinara capital, we were able to buy machinery and increase our turnover by five times to Rs. 1.5 lakhs.”

Tamilselvi

Tamilselvi Appalam Company Tamil Nadu

“My business has been going very well since I got the loans from Kinara Capital. I have even increased the number of workers from 8 to 18.”

Iswarya and Mohan Babu

Mukund Automats

“Once we got the first loan, we grew and grew. Our workforce also grew, we now employ 50 people! The most important factor in our growth and our success is Kinara Capital.”

Frequently Asked Questions FAQ

FAQ

-

What is a GST inclusive amount?

-

What is a GST exclusive amount?

-

What taxes are subsumed under the GST?

-

What are the tax slabs under the GST?