If you are a small business owner looking for an MSME business loan, we are here to help you. We have a 1-minute eligibility check on our website, post which a Kinara loan officer will get in touch with you. Our Loan Officer will continue with the process in your desired language and walk you through the process.

Why choose Kinara Capital?

Get MSME loans from ₹1 lakh to ₹30 lakhs with a digital-first process in your preferred language. We serve 3000+ pincodes and 300+ sectors.

Fast

Get your loan in 24 hours

Flexible

Minimal and flexible documentation process

Friendly

Doorstep customer service to help you from start to finish

Collateral-free Business Loans

We provide doorstep customer service in Telangana and our loan process requires minimum documentation. Our fully digital process can provide you a loan within 24-hours.

-

Tenure

12 to 60 months

-

Rates

Starts at 24%On a reducing rate basis

-

1-30 lakhs

Unsecured loans in Hyderabad

Hyderabad is a cultural melting pot with a rich and colourful history. As the capital of Telangana, it has evolved in leaps and bounds to firmly establish itself in the metropolitan category. While software and consultancy giants like Microsoft, Accenture, Deloitte and IBM have set up offices in Hyderabad, the city still nurtures a wide array of small-scale industries. These businesses primarily deal in the bio-technology, agro-food processing, auto component manufacturing, textile and leather goods manufacturing, pharmaceutical and electronics hardware manufacturing sectors. Given the pace at which Hyderabad is growing, these enterprises have ample opportunities to grow, but might miss out on them due to lack of access to capital through collateral-free loans. Kinara Capital is present in the city to fill this gap by providing SME loans in Hyderabad.

Business Loans in Telangana

Telangana is a newer Indian state and has established itself as an industrial hub since its inception. Known mainly for its architecture and cultural history, the state also houses many industrial complexes and commercial centres. Telangana houses a range of small, medium and large businesses engaged in automobiles and auto components manufacturing, mining and minerals processing, textiles and apparel manufacturing, pharmaceuticals, horticulture, poultry and farming. There are many small businesses that have evolved surrounding these industries and made the most of the opportunities they present. But despite the growth potential that the state presents, it might be a challenge for small business entrepreneurs to get business loans in Telangana. Capital is essential for the growth of a business, and to bridge the gap left by formal lenders, Kinara Capital offers MSME loans in Telangana.

How to get a business loan in Hyderabad?

If you are a small business entrepreneur based in Hyderabad, you might be looking for a way to get MSME loans in Hyderabad to expand your small business. Kinara Capital provides hassle-free business loans to small business entrepreneurs, without asking for collateral. Fill out our 1-minute eligibility check to see if you qualify, and a loan officer will get in touch with you to complete the process. The MSME loan process at Kinara Capital is quick, easy and requires minimal documentation.

MSME loans without collateral

A small business might benefit from an MSME business loan by enabling the owner to buy inventory without waiting for cash flow. MSMEs can also apply for MSME loans to fund their day-to-day operations. As mentioned, MSME loan eligibility is simple, and we do not have lengthy procedures that waste your time. Having the option of accessing capital so quickly and easily means that you can keep growing and expanding your business without worrying about running out of steam. Kinara will help you take your business to the next level.

Our Process

Get a business loan in

3 easy steps!

All you have to do is enter a few details and upload your documents to our secure online portal. We’ll take care of the rest!

-

-

Fast eligibility check

Find out if your business is eligible in just 1 minute! Available in 7 languages. Zero document upload required for eligibility check.

-

Secure KYC & income verification

Provide your personal & business documents. Fully secure online portal with easy upload. Help is at your fingertips with chat or call.

-

Quick loan disbursement

Get money in your account within 24 hours! Digital loan approval with electronic bank deposit.

-

Hear from our Happy Customers

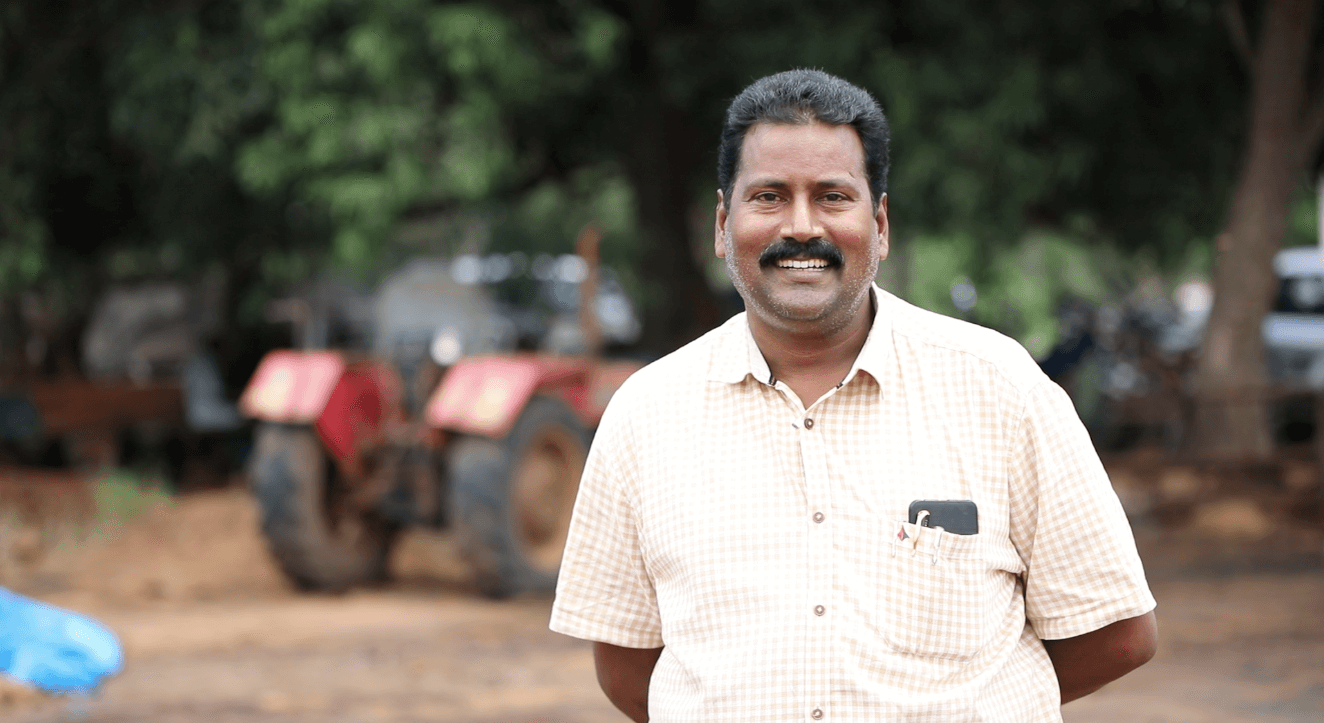

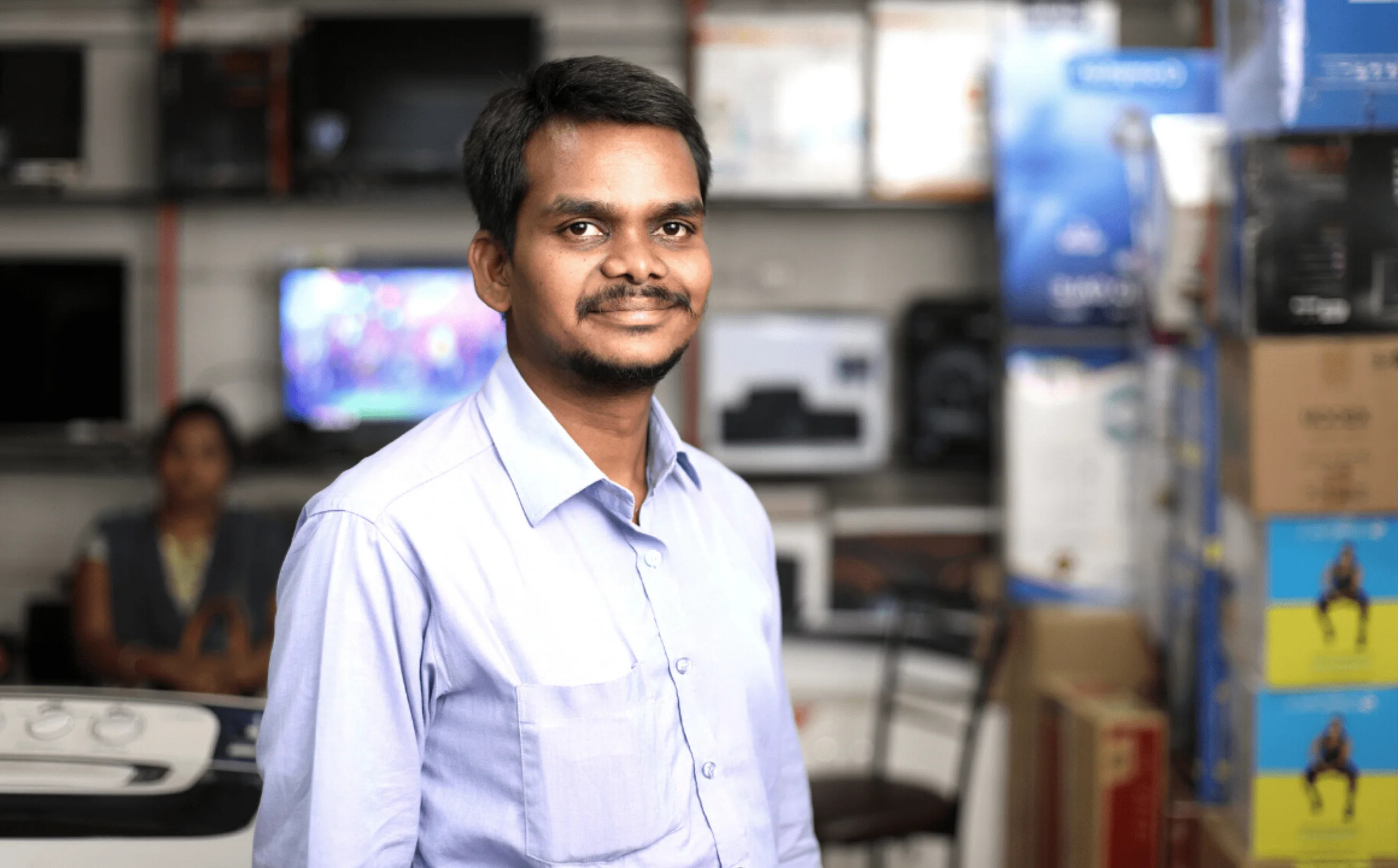

Meet our VikasChampions

With their grit & perseverance, small business owners go on to create local jobs and grow India’s economy. Here’s what they have to say about us!

K. Appa Rao

Hema Electronics

“With Kinara's support, I kept my business running smoothly and growing in leaps and bounds. Now I’m helping others by creating jobs.”

Vaishnavi

GainUp Designs

“Nobody was interested in giving us a loan in the early stages of the business except for Kinara. With the loan, we bought an imported machine, which helped us get new buyers and exporters and establish ourselves in our field.”

Frequently Asked Questions

FAQ

-

How to apply for a business loan in Hyderabad?

-

Is Kinara Capital a bank?

-

Is Kinara Capital registered with/regulated by the RBI?

-

Is the business loan process lengthy?

-

Where is Kinara Capital present?