Policies

1.1. About Kinara Capital

Kinara Capital, a registered brand of Kinara Capital Private Limited (formerly known as Visage Holdings and Finance Private Limited), is a fintech driving financial inclusion of India’s small business entrepreneurs (MSME sector). With its unique blend of tech-enabled processes and doorstep customer service, Kinara Capital leads with the best approach to deliver fast access to formal business credit. The company’s myKinara App is multilingual and the company offers omnichannel customer service. Kinara Capital operates from 133 branches in six (6) states in India servicing 4,000+ pincodes in Tamil Nadu, Karnataka, Andhra Pradesh, Telangana, Gujarat, Maharashtra, and the Union Territory Puducherry. The Company is headquartered in Bengaluru, Karnataka. Kinara Capital is qualified as a Systemically-Important Non-banking Financial Company (NBFC) by the Reserve Bank of India (RBI) and is a debt-listed entity on the Bombay Stock Exchange (BSE).

1.2. Background to ESG Policy

Kinara believes that businesses should be managed in a sustainable manner giving due credence to human rights, environment, the community, and the people working for the businesses. Through its operations, Kinara is driven to make its own contribution in enabling a sustainable world.

Kinara recognizes that its own activities and those of its borrowers have the potential to cause both, adverse and beneficial environmental, social and governance (ESG) impacts. The adverse impacts, if left unaddressed, could translate to credit risks, legal risks and/or reputational risks in the long term. Engagements with the borrowers also present opportunities through down-side risk management and upside value creation in terms of brand differentiation, portfolio performance, stronger relations, and increased loyalty. Kinara is cognizant of the role it can play in influencing MSMEs towards adopting environmentally friendly practices and respecting human rights.

With this background, Kinara has developed an Environmental, Social and Governance Management System (“ESG-MS”) to address ESG risks and opportunities in a structured manner commensurate with the scope and scale of its own and borrower operations. The ESG-MS is guided by Kinara’s ESG Policy and Principles that are aligned with the national and relevant international ESG safeguards to identify, assess, manage, and monitor the ESG risks and enhance opportunities in its business operations.

1.3. Reference Framework

The ESG-MS has been developed with reference to the following frameworks:

2.1. ESG Policy Statement

Through its ESG Policy, Kinara makes a commitment towards contributing to a more sustainable world by taking measures at the appropriate stages to address ESG risks and opportunities in its business operations.

Kinara Capital ESG Policy Statement

Kinara Capital was founded with the mission to transform lives, livelihoods, and local economies by providing fast and flexible loans without collateral to small business entrepreneurs in India. We believe that maintaining an environmental and social balance is key to a sustainable economy.

We are committed to conduct its business in an environmentally sensitive, climate conscious, socially responsible, fair and transparent manner. In line with our commitment, we have developed an ‘Exclusion List’ of sectors to which we will not extend business loans.

In our own operations and in our borrower operations, we will create sensitization on providing employment that is inclusive, gender-responsive, and safe; respect of human rights, conservation of natural resources, generation of low wastes and emissions to protect the environment.

We will comply with all relevant Indian national environmental and social legal requirements and those asked by our partners, on a proactive basis, and encourage borrowers to follow suit.

We are committed to comply with our ESG-MS Policy and will implement appropriate procedures and build organizational capacity to achieve our policy objectives.

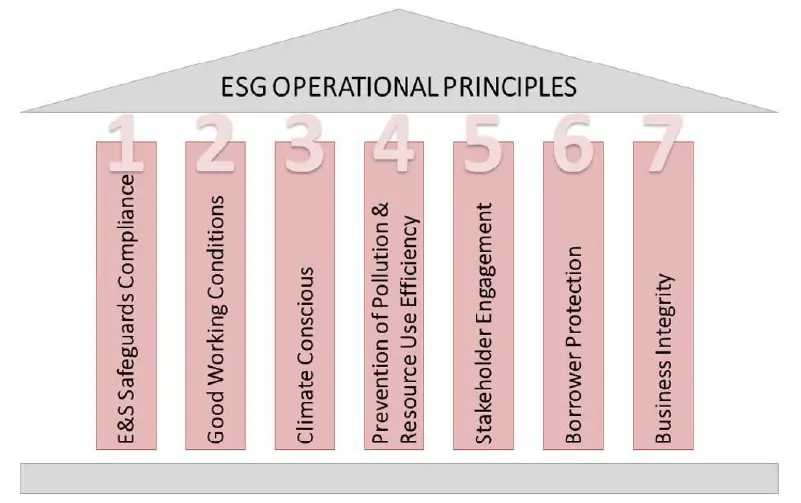

2.2 ESG Operational Principles

The ESG Policy Statement will guide the ESG performance of Kinara and is implemented through the ESG Operational Principles that are applicable to Kinara’s own operations and its borrowers, as relevant. A snapshot of the ESG Operational Principles is presented in Figure 1.

2.3. Approval & Communication

The ESG Policy and Principles have been presented to the Board and are duly approved. The policy shall be applicable from the date of the Board approval, i.e., 07-25-2023 to all Kinara own and borrower operations.

The ESG Policy shall be prominently displayed in all Kinara offices (head office and branches) and communicated to all employees through training programs. It shall also be communicated to other relevant stakeholders, such as investors, shareholders, business partners as relevant. The ESG Policy shall be made available to all other concerned stakeholders on Kinara’s website.

2.4. ESG Policy Implementation

The ESG Policy Statement and Operational Principles is supported by an Environmental, Social and Governance Management System (ESG-MS). The ESG-MS has been formally adopted by the top management to operationalize the ESG Policy in the business.

Under the ESG-MS, the procedures, and tools for ESG risk and opportunity identification, management and monitoring have been developed and integrated with the loan cycle. The institutional structure with roles and responsibilities of various departments towards implementation of the ESG-MS have been defined.

The ESG Policy and underlying procedures will be reviewed on an annual basis by the E&S Committee, to ensure its continuing suitability, adequacy, and effectiveness.