EMI is calculated using a formula that factors in the loan amount, interest rate and loan tenure. The easiest way to figure out the EMI for your business loan is to use an online EMI calculator tool, which can show you the accurate amount in seconds.

Why choose Kinara Capital?

Get MSME loans from ₹1 lakh to ₹30 lakhs with a digital-first process in your preferred language. We serve 4,500+ pincodes and 300+ sectors.

Fast

Get your loan in 24 hours

Flexible

Minimal and flexible documentation process

friendly

Doorstep customer service to help you from start to finish

Find out your EMI amount in seconds

with Kinara’s loan

EMI calculator!

The EMI amount is one of the most important considerations when deciding to take a business loan. Only when you know how much you will be paying each month, can you take an informed decision and successfully service your loan. Kinara’s loan EMI calculator will make sure you don’t have to go through the hassle of doing the calculations yourself. Simply put in your loan amount, tenure, and interest rate, and we’ll do the rest. In just a few seconds you will know what your monthly EMI outgo will be when you take the loan!

EMI calculator

₹100000

₹3000000

6 Months

5 Years

24

30

Monthly EMI

What is Business Loan EMI?

Business loans can be repaid in equated monthly installments (EMIs). An EMI is the payment of a fixed amount made by the borrower to the lender on a specified date each month. Equated monthly installments are applied to both interest and principal each month, so that over a certain number of years, the loan is paid off in full.

EMIs make loan repayment easy and keep your finances from being overstretched in attempting to pay off the credit. By spreading out the installments over a period of time and having a fixed date for each payment, this system allows you to be prepared with the amount, so that you never miss a payment.

How to use a Business Loan EMI Calculator?

Opting for a business loan is an excellent way to give your business the boost it needs. But the first thing to determine is the loan amount you will need, and subsequently, whether you will be able to service the loan. A business loan EMI calculator can help you decide by displaying the exact EMI amount you will need to pay. To use the calculator, simply enter the loan amount, interest rate and loan tenure and hit “calculate”. If you are unsure about any of the variables, you can try different permutations to arrive at a number that works for you.

How is the reducing rate of interest calculated?

All loans issued by Kinara have interest calculated on a reducing rate basis. A reducing rate of interest or diminishing interest rate is calculated monthly on only the outstanding loan amount. This means that once you successfully pay your monthly EMI, the reducing interest rate for the next month will be calculated on only the outstanding amount rather than the entire principal amount. Over time, this lowers the EMI amount you are required to pay and eases the repayment process.

Factors Affecting Business Loan EMI

Various factors affect the business loan interest rates and EMI, including the lender’s policy and macro factors. Aside from these, factors that may affect the interest rate, loan amount and therefore the EMI you are required to pay may include the profitability and cash flow of your business, your credit history, net income and the type of business you own.

Our Process

Get a business loan in

3 easy steps!

All you have to do is enter a few details and upload your documents to our secure online portal. We’ll take care of the rest!

-

-

Fast eligibility check

Find out if your business is eligible in just 1 minute! Available in 7 languages. Zero document upload required for eligibility check.

-

Secure KYC & income verification

Provide your personal & business documents. Fully secure online portal with easy upload. Help is at your fingertips with chat or call.

-

Quick loan disbursement

Get money in your account within 24 hours! Digital loan approval with electronic bank deposit.

-

Hear from our Happy Customers

Meet our VikasChampions

With their grit & perseverance, small business owners go on to create local jobs and grow India’s economy. Here’s what they have to say about us!

Anupama Chenna

Sri Padmavathi Enterprises Gajuwaka

"Since we got our first loan from Kinara, business has improved, increasing our turnover to Rs. 15 lakhs from Rs. 1-2 lakhs in 8 months.”

M Banu

KMB Metal Works

“With two collateral-free loans from Kinara capital, we were able to buy machinery and increase our turnover by five times to Rs. 1.5 lakhs.”

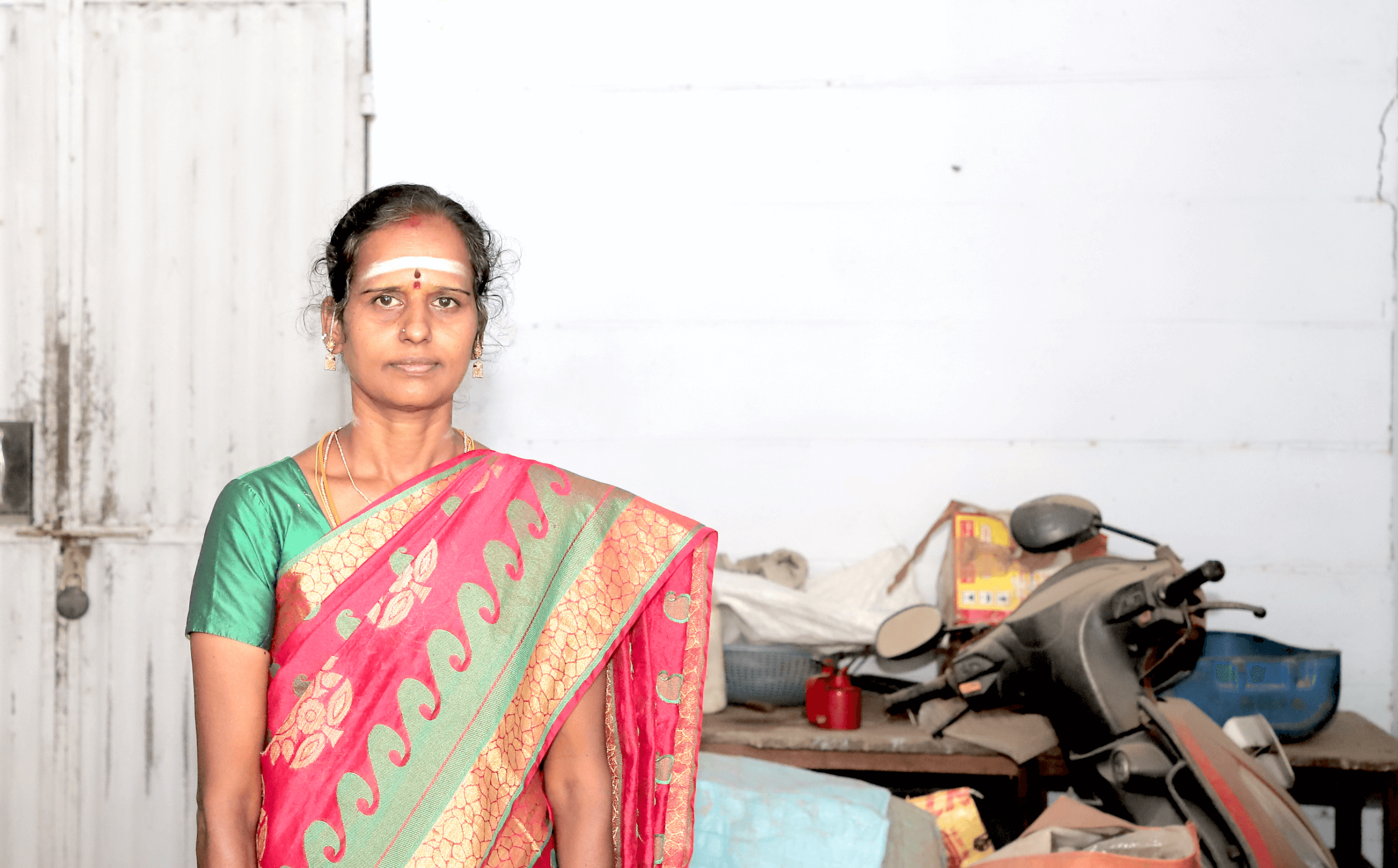

Tamilselvi

Tamilselvi Appalam Company Tamil Nadu

“My business has been going very well since I got the loans from Kinara Capital. I have even increased the number of workers from 8 to 18.”

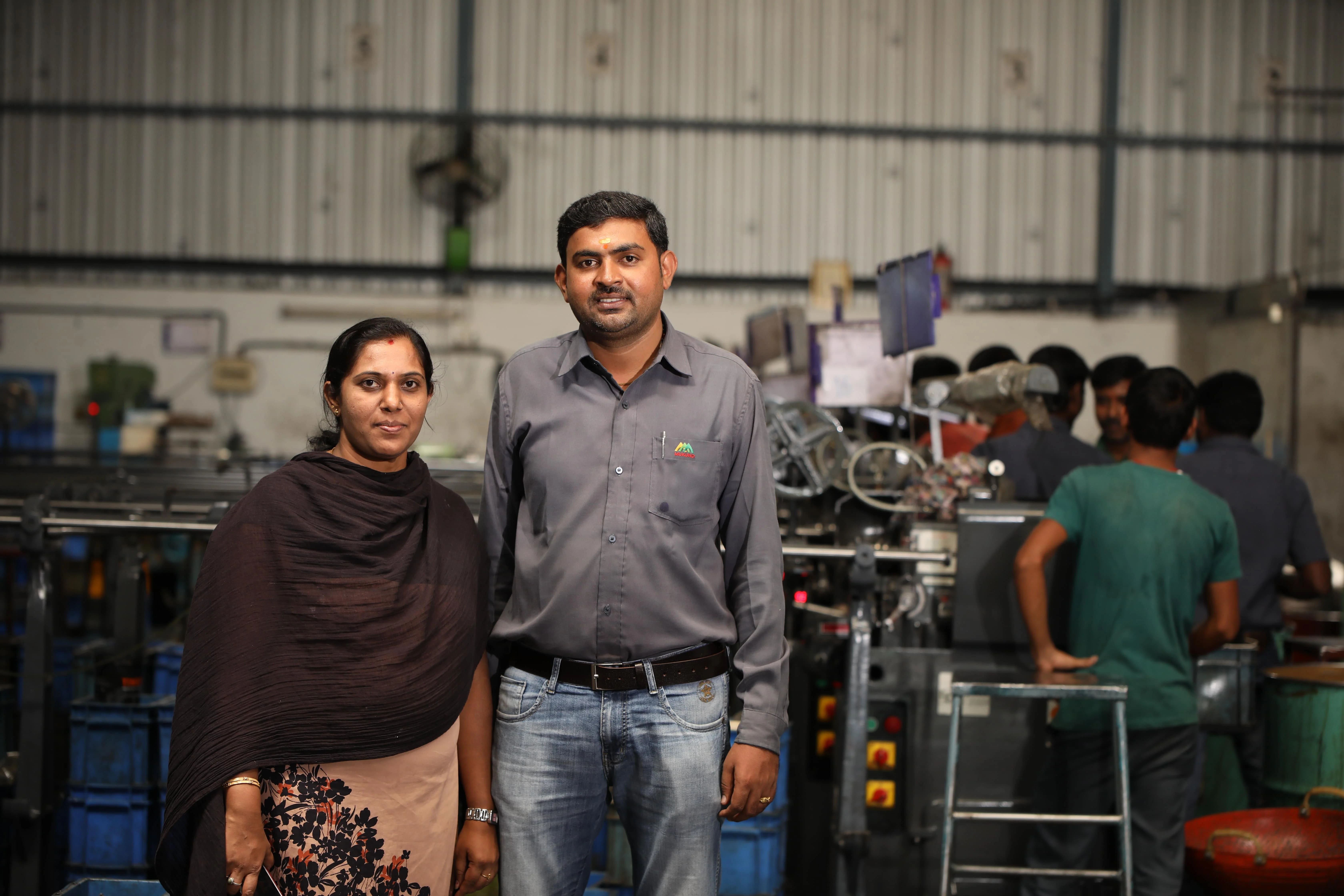

Iswarya and Mohan Babu

Mukund Automats

“After we got the first loan, we kept growing, and our workforce expanded to 50! Kinara has been the most important factor in our success.”

Frequently Asked Questions

FAQ

-

How is EMI calculated?

-

How is a loan repaid through EMIs?

-

How do I start the EMI deductions?

-

How do I stop the EMI deductions?