The interest rates of Kinara Capital’s Business loans start at 24%, and are calculated on a reducing rate basis. This means that the EMIs reduce with each repayment, because the interest is calculated on the outstanding loan amount, rather than the total principal disbursed at the outset.

Why choose Kinara Capital?

Get MSME loans from ₹1 lakh to ₹30 lakhs with a digital-first process in your preferred language. We serve 4,500+ pincodes and 300+ sectors.

Fast

Get your loan in 24 hours

Flexible

Minimal and flexible documentation process

Friendly

Doorstep customer service to help you from start to finish

Pay lower EMIs on reducing rate balance

Business loan interest rates are a crucial factor in determining what your EMI amount will be. Kinara Capital’s loan interest is calculated on a reducing rate basis, which results in lower EMIs with each repayment.

-

Tenure

12 to 60 months

-

Rates

Starts at 24%On a reducing rate basis

-

Amount

1-30 lakhs

EMI calculator

₹100000

₹3000000

6 Months

5 Years

24

30

Monthly EMI

Reducing interest rate on a business loan

A business loan is a form of financing extended to entrepreneurs by financial institutions to fund the various operational expenses associated with their company. Business loans are an easy way to finance expenses, from regular ones like employee salaries and overheads, to larger outlays like machinery purchase. Business loans can be serviced through equated monthly installments (EMIs), which pay off a portion of the principal amount as well as the interest accrued. The interest rate on a business loan is determined based on several factors, including loan amount, tenure, and the lender’s policy, and can vary significantly. Kinara Capital’s business loan interest rate is calculated on a reducing rate basis, which means that as the outstanding loan amount gets smaller with each repayment, the EMI amount reduces as well. This is because the interest is calculated on the outstanding loan amount, rather than the total principal disbursed at the outset.

Kinara Capital business loan interest rate and charges

Kinara Capital offers business loans for working capital and machinery purchase for micro-small-and-medium enterprises (MSMEs). These collateral-free loans are offered with minimal documentation and can be disbursed within as little as 24 hours after approval. Kinara Capital’s loans accrue interest starting at a rate of 24% p.a., and the interest is calculated on a reducing rate basis.

How to calculate interest on business loans

The interest accrued on a business loan is calculated based on the principal loan amount, interest rate, and loan tenure. Interest on Kinara Capital’s business loans starts at 24% p.a., and is calculated on a reducing rate basis. This means that as the outstanding loan amount gets smaller with each repayment, the EMI amount reduces as well. This is because the interest is calculated on the outstanding loan amount, rather than the total principal disbursed at the outset.

Factors affecting the business loan interest rates

Various factors affect the interest rate of a business loan. Among these are macro factors like the sector and geography within which the business operates. In addition to these, the following individual factors might influence the interest rate as well: the loan amount required, the business turnover, the purpose of the loan (in the case of machinery purchase, whe there's hypothecation), the bank statement, cashflow and credit score (if available)

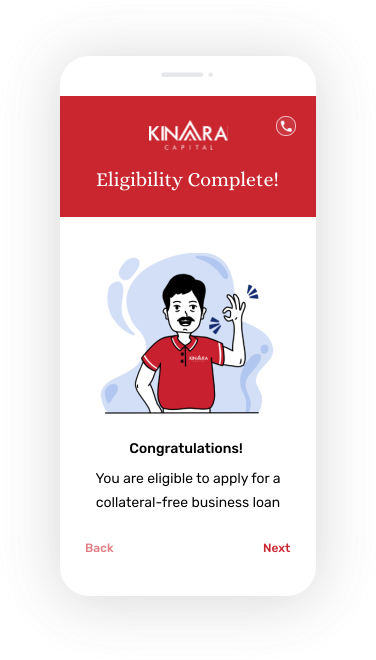

Our Process

Get a business loan in

3 easy steps!

All you have to do is enter a few details and upload your documents to our secure online portal. We’ll take care of the rest!

-

-

Fast eligibility check

Find out if your business is eligible in just 1 minute! Available in 7 languages. Zero document upload required for eligibility check.

-

Secure KYC & income verification

Provide your personal & business documents. Fully secure online portal with easy upload. Help is at your fingertips with chat or call.

-

Quick loan disbursement

Get money in your account within 24 hours! Digital loan approval with electronic bank deposit.

-

Hear from our Happy Customers

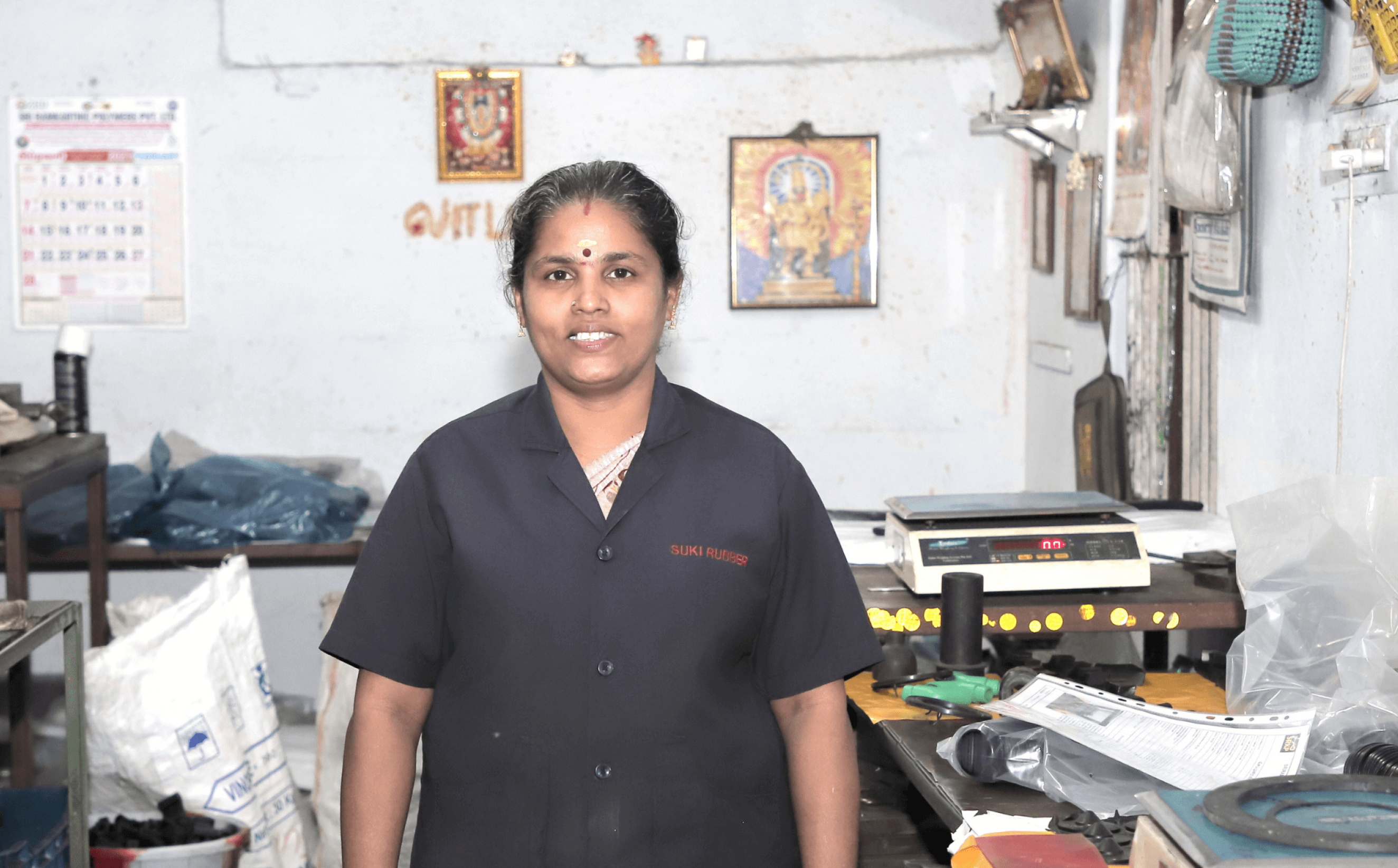

Meet our VikasChampions

With their grit & perseverance, small business owners go on to create local jobs and grow India’s economy. Here’s what they have to say about us!

A.Geetha

Suki Rubber Products

“Kinara has supported me throughout. When I paid off my first loan, I was able to apply for another one and keep growing my business.”

Anupama Chenna

Sri Padmavathi Enterprises Gajuwaka

"Since we got our first loan from Kinara, business has improved, increasing our turnover to Rs. 15 lakhs from Rs. 1-2 lakhs in 8 months.”

Guntha Harish

Sai Ram General Stores

“My business and earnings had hit a plateau. With the loan from Kinara, I was able to set up another shop and double my income.”

Frequently Asked Questions

FAQ

-

What is the interest rate for business loans in Kinara Capital?

-

How to calculate the interest rate on a business loan?

-

What is the repayment period of a business loan?