If you are a small business owner looking for an MSME business loan, we are here to help you. We have a 1-minute eligibility check on our website, post which a Kinara loan officer will get in touch with you. Our Loan Officer will continue with the process in your desired language and walk you through the process.

Why choose Kinara Capital?

Get MSME loans from ₹1 lakh to ₹30 lakhs with a digital-first process in your preferred language. We serve 4,500+ pincodes and 300+ sectors.

Fast

Get your loan in 24 hours

Flexible

Minimal and flexible documentation process

Friendly

Doorstep customer service to help you from start to finish

Collateral-free Business Loans

We provide doorstep customer service in Gujarat and our loan process requires minimum documentation. Our fully digital process can provide you a loan within 24-hours.

-

Tenure

12 to 60 months

-

Rates

Starts at 24%On a reducing rate basis

-

1-30 lakhs

Unsecured loans in Surat

Surat was once a thriving port town, and has now firmly established itself as the economic and commercial centre of the southern part of Gujarat.It is one of the largest urban areas of western India. It has well-established diamond and textile industries, and is a shopping centre for apparels and accessories. There are thousands of small and medium businesses in Gujarat engaged in the manufacturing

Business Loans in Gujarat

Gujarat is one of the wealthiest states in the country, and also among the leaders in terms of infrastructure and a developmental push from the government. Gujarat is one of India's most industrialized states, and houses a wide variety of industries. There are thousands of small businesses and manufacturing units in the state, but they may not have easy access to capital because of the risk aversion of traditional lenders. Such businesses can turn to Kinara Capital, which offers quick and easy business loans in Gujarat.

How to get a business loan in Surat?

If you have a small business based in Surat, you might have faced your share of difficulties in securing access to capital. This is because many traditional lenders like banks refuse to provide loans to small businesses, especially without collateral. Thankfully there is an easier way to get a loan for a Small businesses; you can approach Kinara Capital for a loan instead. All you have to do to get MSME loans in Surat is log on to the Kinara Capital website and fill out our 1-minute eligibility check to see if you qualify for a loan. If you do, a loan officer will get in touch with you to complete the process. The MSME loan process at Kinara Capital is quick, flexible and requires limited documentation.

Easy Business loans for MSMEs

Small Business Entrepreneurs know how hard it can be to get a business loan. Without collateral, they are often turned away by banks. Often, business owners are frustrated with missed opportunities because they simply don’t have the funds to fulfil new orders. Time is of the essence in such cases and this is why fast & flexible loans from Kinara Capital are ideal for small business entrepreneurs. With minimal documentation required, and a Customer Service officer available to provide guidance to you throughout the loan process. You can get easy access to business loans from Rs. 1 lakh upto Rs. 30 lakhs.

Our Process

Get a business loan in

3 easy steps!

All you have to do is enter a few details and upload your documents to our secure online portal. We’ll take care of the rest!

-

-

Fast eligibility check

Find out if your business is eligible in just 1 minute! Available in 7 languages. Zero document upload required for eligibility check.

-

Secure KYC & income verification

Provide your personal & business documents. Fully secure online portal with easy upload. Help is at your fingertips with chat or call.

-

Quick loan disbursement

Get money in your account within 24 hours! Digital loan approval with electronic bank deposit.

-

Hear from our Happy Customers

Meet our VikasChampions

With their grit & perseverance, small business owners go on to create local jobs and grow India’s economy. Here’s what they have to say about us!

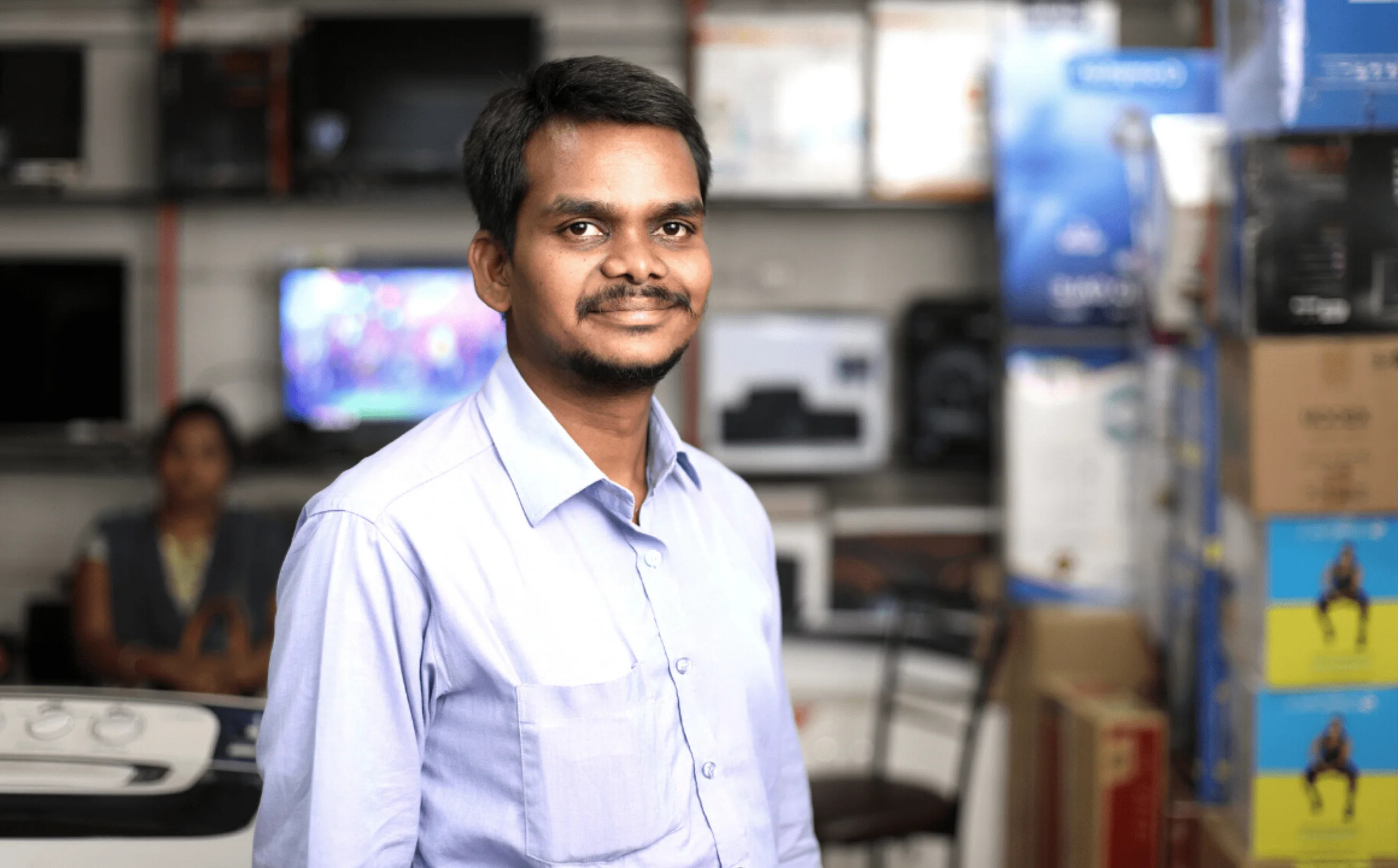

K. Appa Rao

Hema Electronics

“With Kinara's support, I kept my business running smoothly and growing in leaps and bounds. Now I’m helping others by creating jobs.”

Nishit Shah

Nishit Tech

"Kinara supported me when I was in need of money for my small business. Since then, I've doubled my turnover & hired 4 new employees.”

Vishwanathan

Sri Sai Candles

“Small factories like ours simply can't get a loan from banks. With Kinara Capital, you don’t even have to go anywhere, they come to you!”

Frequently Asked Questions

FAQ

-

How to apply for a business loan in Surat?

-

Is Kinara Capital a bank?

-

Is Kinara Capital registered with/regulated by the RBI?

-

Is the business loan process lengthy?

-

Where is Kinara Capital present?