We offer two types of unsecured the business loans. The first is working capital loans, which help you finance your day-to-day business expenses. The second is machinery purchase loans, with which you can buy old or new machinery to improve the quality of your products, and production speed.

Why choose Kinara Capital?

Get MSME loans from ₹1 lakh to ₹30 lakhs with a digital-first process in your preferred language. We serve 4,500+ pincodes and 300+ sectors

Fast

Get your loan in 24 hours

Flexible

Minimal and flexible documentation process

Friendly

Doorstep customer service to help you from start to finish

Business loans for MSMEs to grow

Kinara Capital has supported 35,000+ small businesses across India. Get a collateral-free MSME business loan for your various operational requirements.

-

Tenure

12 - 60 months

-

Rates

Starts at 24%

-

1-30 lakhs

Features of MSME/SME Loan

• With a flexible and digital application process, Kinara Capital can provide collateral-free MSME loans in just 24-hours.

• Multi-lingual support is available throughout the process with doorstep customer service. We provide SME loans to 300+ sectors, across 90+ cities and 3,000 pin codes.

• Small businesses can avail of our loans to meet a range of business expenses and to expand their operations.

• Business owners can apply for MSME Loan starting with a quick 1-minute eligibility check.

Benefits of MSME/SME Loan

MSME/SME loans offer various benefit to small business entrepreneurs, including:

• They can support the improvement and expansion of business operations by adding machinery, equipment and other necessities

• They can be easily availed of, and in Kinara’s case, are issued without the need to provide any form of security or collateral.

• Kinara’s MSME loans are fast and flexible, and require minimal documentation.

• Kinara provides easy and hassle-free repayment options.

• Kinara’s MSME loans have an extremely short turnaround time. You can receive your loan amount in just 24 hours after approval.

• Our MSME loans make special allowances, gauging the creditworthiness of a business or entrepreneur by considering various factors, instead of relying solely on credit history or score.

Eligibility Criteria for MSME Loan

To avail of an MSME loan from Kinara Capital, the first step is to ensure that you meet the basic eligibility criteria. To qualify for a MSME loan from Kinara Capital, you need to meet the following criteria:

• Your business should be part of the manufacturing, trading or services sector.

• The pin code should be one of 4,500+ where Kinara Capital is already offering services.

• Total monthly turnover should be greater than Rs. 50,000 and less than Rs. 2 crores.

• The business should fall under the list of sectors and sub-sectors serviced by Kinara.

• Your business must be 2+ years old.

MSME Loan Interest Rates

MSME loan interest rate can vary depending on the purpose and tenure of the loan, as well as the lender’s policy and the borrower’s credit history. Kinara Capital’s interest rates start at 24% per annum and are calculated on a reducing rate basis, which means you can end up paying interest of only 1% a month. Interest being calculated on a reducing rate basis means that as your outstanding loan amount goes down with repayments, so will your interest outgo. Over the long term, this will reduce your EMI payment and make repayment easy and affordable.

Documents Required for MSME/SME Loan

Traditional lenders like banks have a long and tedious application process and require extensive documentation for issuing an MSME loan. This is largely because such lenders are risk-averse and consider small businesses to be high-risk borrowers who are more likely to default. This is even more so the case when it comes to unsecured loans, or loans which don’t require any collateral. Kinara Capital on the other hand, has proprietary data-led back-end processes to determine creditworthiness, and can therefore offer a quick and simple loan process requiring minimal documentation. To apply for business loan from Kinara Capital, you will need the following documents:

• Applicant, co-applicant and business KYC documents (ID and address proof) Applicant’s PAN card

• Business registration document

• Last 12 months’ bank statements

How to Apply for Kinara Capital MSME Loan?

Kinara Capital has a quick MSME business loan process. After the initial application process and approval, a loan can be disbursed within just 24-hours. You can get started with an MSME loan eligibility check on our website. If you are eligible, a Kinara Loan Officer will be in touch for the rest of the process. Once your application is verified and approved, your small business loan will be disbursed. Our documentation process is flexible and allows for the substitution of certain documents with others, subject to availability. Now you can also download the myKinara app and take the eligibility check on it. If you qualify, you can complete the application process using the app.

Our Process

Get a business loan in

3 easy steps!

All you have to do is enter a few details and upload your documents to our secure online portal. We’ll take care of the rest!

-

-

Fast eligibility check

Find out if your business is eligible in just 1 minute! Available in 7 languages. Zero document upload required for eligibility check.

-

Secure KYC & income verification

Provide your personal & business documents. Fully secure online portal with easy upload. Help is at your fingertips with chat or call.

-

Quick loan disbursement

Get money in your account within 24 hours! Digital loan approval with electronic bank deposit.

-

Hear from our Happy Customers

Meet our VikasChampions

With their grit & perseverance, small business owners go on to create local jobs and grow India’s economy. Here’s what they have to say about us!

Vaishnavi

GainUp Designs

“Nobody was interested in giving us a loan in the early stages of the business except for Kinara. With the loan, we bought an imported machine, which helped us get new buyers and exporters and establish ourselves in our field.”

Karthikeyan AS

ASK Three Star Steels

“We got the funding from Kinara to install a powder coating unit, which triple our turnover from Rs. 1 to Rs. 3 crores a year!”

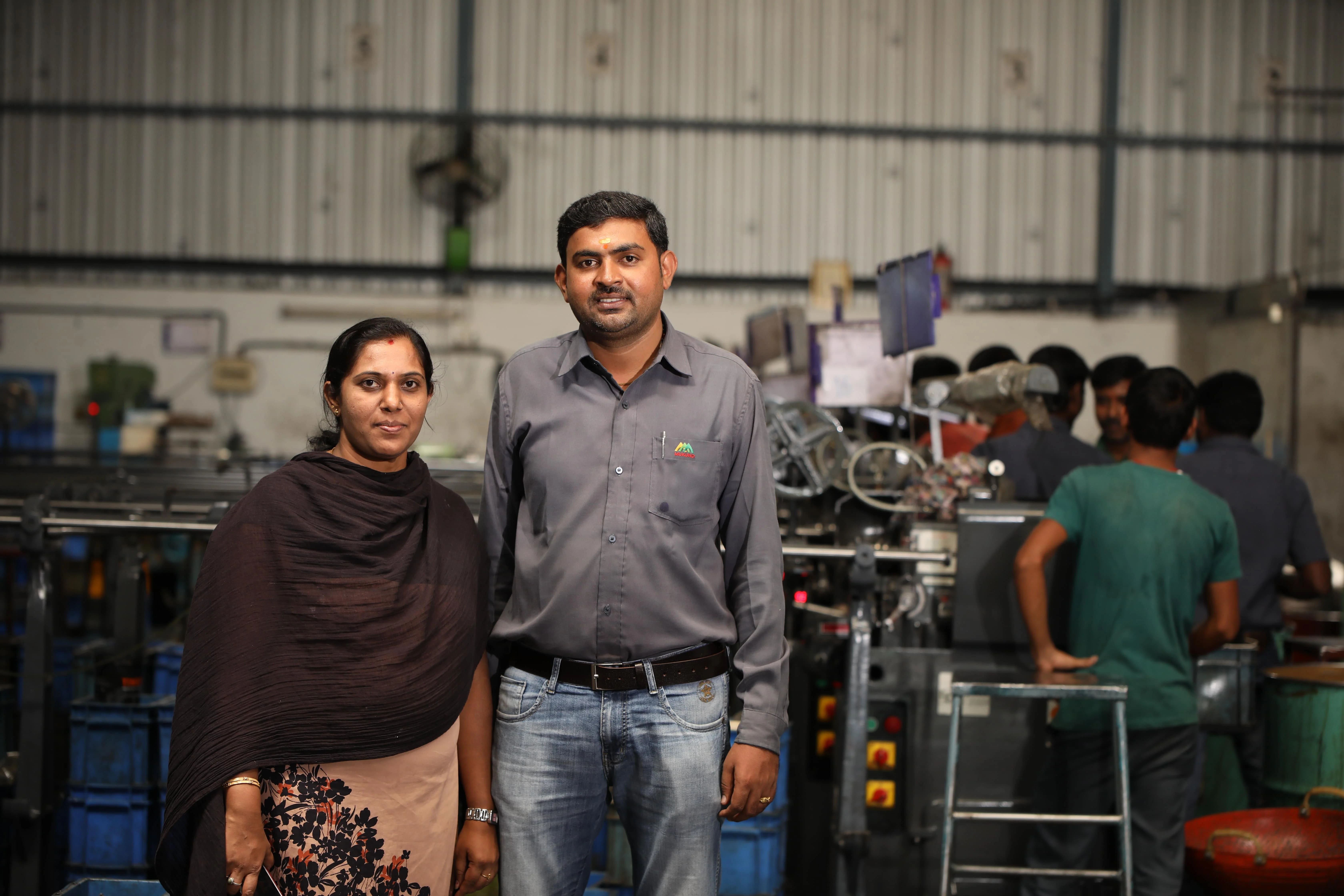

Iswarya and Mohan Babu

Mukund Automats

“After we got the first loan, we kept growing, and our workforce expanded to 50! Kinara has been the most important factor in our success.”

Amar Singh

Sai Balaji Electronics

“Kinara is like my best friend. With their support I have doubled my turnover and improved my life.”

Frequently Asked Questions

FAQ

-

What are the types of MSME loans offered by Kinara Capital?

-

Which sectors are covered by MSME loans?

-

What are the documents required for availing MSME loans?

-

Why choose Kinara Capital?

-

What is the MSME Loan Eligibility Criteria?