Press Coverage

-

Moneycontrol | October 27, 2021

Second COVID wave batters microfinance, lenders positive on outlook

Our CEO Hardika Shah talks about the impact of COVID- 2 on small and micro businesses. She also speaks about sudden dip in the revenue in this industry story.

Read MoreForbes Advisor | October 26, 2021Top Factors That Influence Business Loan Interest Rates

In the authored article for Forbes, our Founder & CEO Hardika Shah highlights the top macro and individual factors that influence business loan issuance and their interest rates in the industry.

Read MoreForbes | October 26, 2021Top Factors That Influence Business Loan Interest Rates

Business loans are a critical tool for entrepreneurs to run and expand their businesses. This need is especially acute for small business owners, who do not have as much liquidity and capital access as larger enterprises. This is further complicated by the fact that micro, small and medium enterprises (MSMEs) in India are hard-pressed to find lenders who would provide them with loans without asking for collateral(s) or a security.

Read MoreET Rise | October 13, 2021U GRO Capital and Kinara Capital announce co-origination partnership for MSME loans

Our CEO, Hardika Shah speaks about the partnership with U GRO and how it will allow Kinara to expand its footprint by sharing both balance sheet and risk.

Read MoreThe Financial Express | October 13, 2021 EnglishMSME lenders U GRO Capital, Kinara Capital to Co-Originate Rs 100 Crore Loans to Small Businesses

Kinara Capital announces a strategic co-origination tie-up with MSME lender, U GRO Capital for providing collateral-free loans to small businesses. Through this partnership, the company is set to disburse around Rs 100 crore in the next eight-12 months to MSMEs across the manufacturing, trading, and services sectors.

Read MoreAll Things Talent Magazine | September 7, 2021Cultivating Adaptability for the Future of Work: A Move beyond the Rhetoric

In an exclusive interview with All Things Talent, Gracy Tavamani, Head of HR at Kinara Capital talks about the challenges of retaining talent, the future of work, and how the COVID-19 pandemic disrupted the job market and changed the hiring process forever. She also shares some valuable insights on how Adaptability Quotient (AQ) has emerged as the new competitive advantage in the post-pandemic world.

Read MoreET BFSI | July 18, 2021Consumer Awareness needs to keep pace with regulations to protect consumers from the lure of fraudulent Instant Loan Apps

In an in depth article for ET BFSI, our Founder and CEO, Hardika Shah talks about improving consumer awareness regarding financial services and enforcing EMI facility and loan agreements as a practice.

Read MoreMichael & Susan Dell Foundation | October 13, 2021Kinara Capital loan advances small business in India

Michael & Susan Dell Foundation features Kinara Capital's business model

Read MoreBloomberg Quint | August 13, 2021Facebook Aims To Close India’s SME Credit Gap. But Is It Enough?

In the industry story by Bloomberg Quint, our Founder and CEO highlights how Facebook's initiative to promote small business lending in India brings much-needed attention to this undeserved market.

Read MoreCNBC | August 13, 2021How family dynamics shaped these tech CEOs into the leaders they are today.

In candid conversation CNBC TechCheck’s Jon Fortt dives into the story of Kinara Capital Founder & CEO Hardika Shah along with Altair CEO, Jim Scapa, CEO of Upwork Hayden Brown, and René Lacerte, Bill.com Founder and CEO.

Read MorePeople Matters | July 14, 2021How to nurture an innovative hybrid workforce?

Our Founder and CEO, Hardika Shah talks about ways to nourish company culture, importance of digitization and work-life balance in the article.

Read MoreET CFO | July 1, 2021GST made it easier for MSMEs to do business but fix connectivity, reduce filings: Kinara Capital CFO

In an interaction with ET CFO, our CFO Aiswarya Ravi, talks about the GST regime and how its compliance has helped small businesses to improve their creditworthiness and reduced supply barriers.

Read MoreYourstory | July 28, 2021Can MSMEs and small businesses survive a potential third wave?

In an interview with YourStory, our Founder and CEO Hardika Shah talks about the need of digitisation in MSME sector and how it is important to survive amidst pandemic.

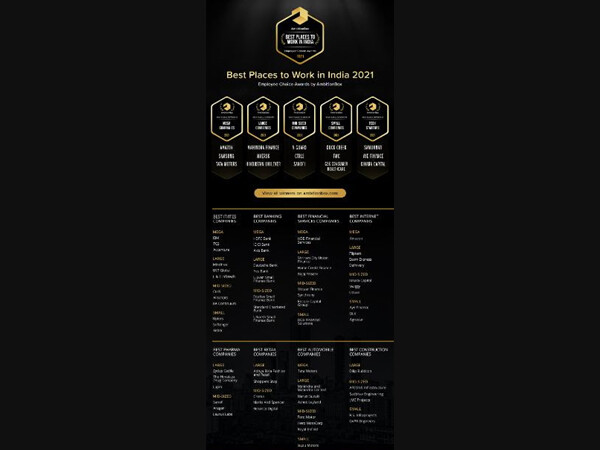

Read MoreBusiness Standard | July 12, 2021AmbitionBox announces best places to work in India 2021, India’s First Employee Choice Awards

"AmbitionBox, an Info Edge subsidiary and a rapidly growing career advisory platform, awarded Kinara Capital as the Best Internet Companies in the mid-sized company category"

Read MoreKinara Capital secures USD 10 mn from IndusInd Bank

"Kinara lends to MSMEs across manufacturing, trading and services sectors, Hardika Shah, founder and chief executive said. Roopa Satish of IndusInd Bank said the DFC guarantee eliminates forex fluctuation risks from the balance sheet of Kinara and it has become an important tool to mobilise debt funding for impact space companies. Loren Rodwin of DFC said Kinara's commitment towards financial inclusion has made it possible for us to collaborate with India's small businesses."

Read MoreThe Week | February 22, 2021Kinara Capital Secures USD 10 Million from IndusInd Bank with 100 Percent Guaranty from U.S. International Development Finance Corporation DFC

"Kinara lends to MSMEs across manufacturing, trading and services sectors, Hardika Shah, founder and chief executive said. Roopa Satish of IndusInd Bank said the DFC guarantee eliminates forex fluctuation risks from the balance sheet of Kinara and it has become an important tool to mobilise debt funding for impact space companies. Loren Rodwin of DFC said Kinara's commitment towards financial inclusion has made it possible for us to collaborate with India's small businesses. "

Read MoreET Rise | February 22, 2021Kinara Capital gets $10 mn from IndusInd Bank to further MSME financial inclusion

Our partnership with IndusInd and DFC underscores our shared commitment to ease the credit hurdle faced by most small business entrepreneurs in India,” said Hardika Shah, Founder & CEO, Kinara Capital, “MSMEs galvanize India's economy with income generation and job creation and there is an ever increasing demand for financing for businesses to rebuild and grow this year. This investment from IndusInd Bank and DFC will accelerate financial inclusion of small businesses, thereby invigorating local economies." "We are glad to have associated with DFC to support a strong impact creating entity, Kinara Capital, in their growth trajectory,” said Roopa Satish "We hold the organizations that we fund to a very high standard and Kinara Capital is a role model when it comes to last-mile delivery,” said Loren Rodwin

Read MoreTechin Asia | March 9, 2021Indian fintech firm Kinara Capital bags $7m in funding for women entrepreneurs

Read MoreEntrepreneur India | March 29, 2021The Small Business Savior

We are solving the Missing Middle problem, the credit chasm between informal and formal lending for small businesses is estimated by the World Bank to be USD$380 billion in India. The micro-small-medium-enterprise (MSME) sector forms an important part of the economy by contributing to 45% of India’s exports, 30% of the national GDP, and providing employment to over 100 million people in the country. The inception of Kinara Capital was catalyzed by the realization that despite the many economic reforms that India had undergone, including the tech boom, economic liberalization and globalization, small business owners were facing the same challenges and remained severely limited by the lack of access to formal funding.

Read MoreEntrepreneur India | January 29, 2021MSMEs And NBFCs Lending To Them Need Government Boost To Stay On Recovery Path

Authored Article

Read MoreKinara Capital is a registered brand of Kinara Capital Private Limited

2024 Kinara Capital. All Rights Reserved

(formerly known as Visage Holdings and Finance Private Limited)Get in touch

- [email protected]Email

- 1800 103 2683Toll Free

Monday - Friday | 9.30AM - 6.00PM - 7026290000Missed Call

Product

Company Information

Quick Links