With myKinara process, you can complete the process and receive disbursement of Machinery Purchase loan for upto Rs. 30 lakhs within 24-hours. We are also here to help you over the phone, or our local officer can visit you to help complete the process.

Making Machinery Loans quick & easy

Make use of our Machinery Purchase Loans to buy new or second-hand machinery, and improve your business productivity, product quality and increase your turnover.

-

Tenure

12 to 60

months -

Rates

Starts at 24%On a reducing rate basis

Why choose Kinara Capital?

Get MSME loans from ₹1 lakh to ₹30 lakhs with a digital-first process in your preferred language. We serve 4,500+ pincodes and 300+ sectors.

Fast

Get your loan in 24 hours

Flexible

Minimal and flexible documentation process

Friendly

Doorstep customer service to help you from start to finish

Grow your business

with our support

Purpose of Loans

Increase your business efficiency by purchasing new or second-hand equipment and machinery.

-

New Machine Purchase

-

Second-hand Machine Purchase

EMI Calculator

₹1 lakh

₹30 lakhs

6 Months

5 Years

24

30

Approximate Monthly EMI

Loans for all MSMEs

We provide collateral-free business loans to MSMEs across all sectors.

Hear from our Happy Customers

Meet our VikasChampions

With their grit & perseverance, small business owners go on to create local jobs and grow India’s economy. Here’s what they have to say about us!

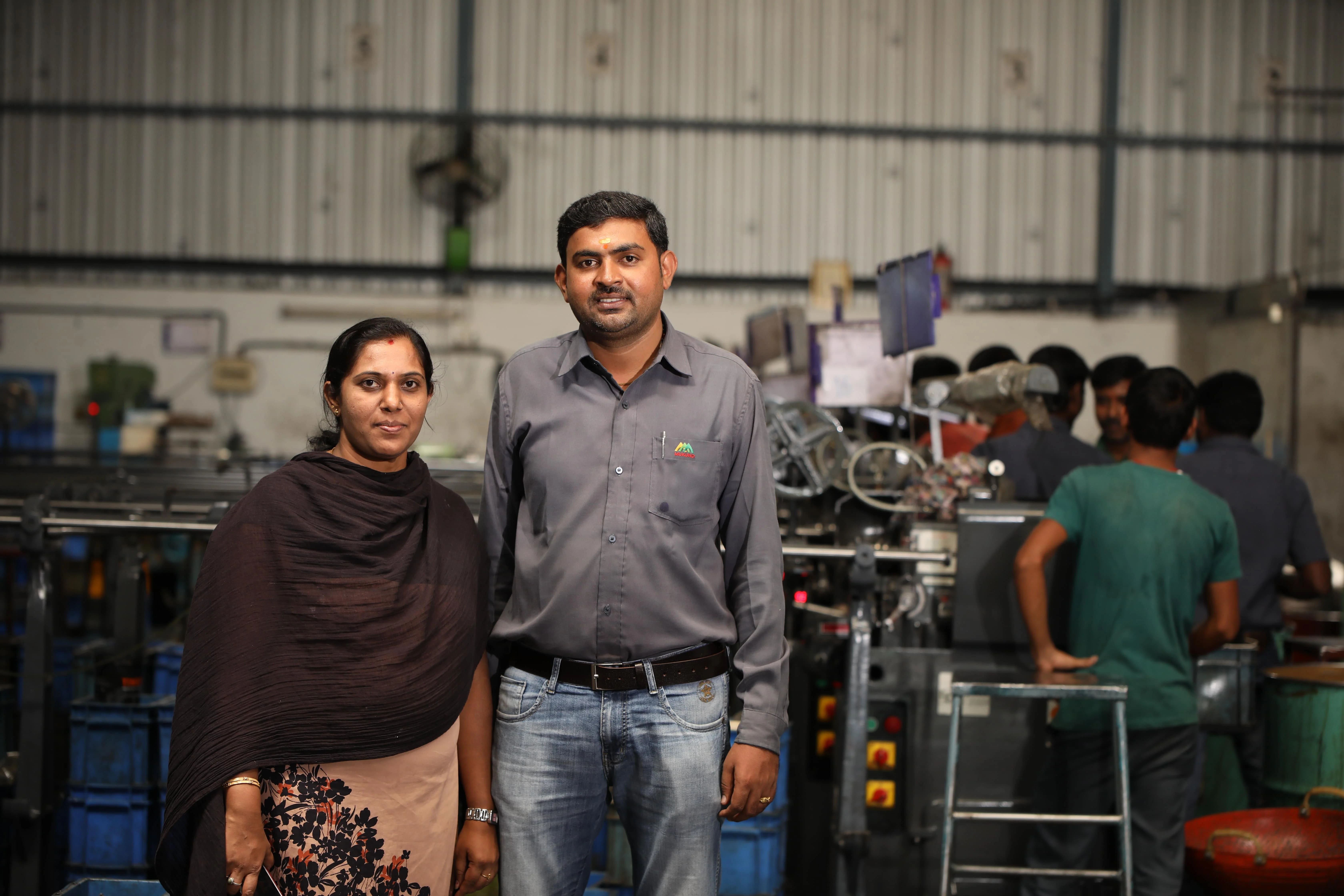

Vaishnavi and Karthik Babu

GainUp Designs

“With the loan, we bought an imported machine, which helped us get new buyers and exporters and establish ourselves in our field.”

Read Full Story

Iswarya and Mohan Babu

Mukund Automats

“After we got the first loan, we kept growing, and our workforce expanded to 50! Kinara has been the most important factor in our success.”

Read Full Story

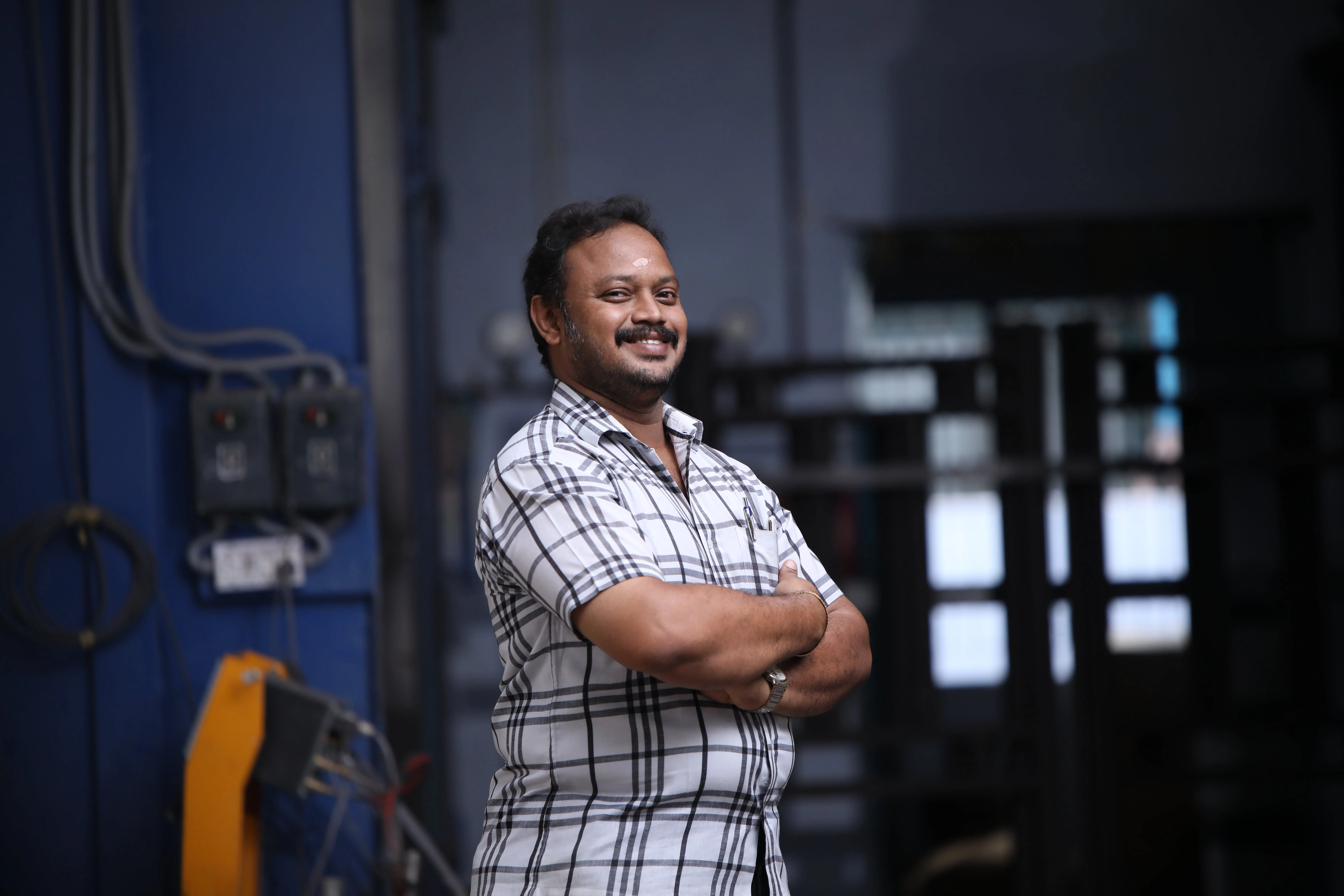

Karthikeyan AS

ASK Three Star Steels

“We got the funding from Kinara to install a powder coating unit, which triple our turnover from Rs. 1 to Rs. 3 crores a year!”

Read Full Story

Vishwanathan

Sri Sai Candles

“Small factories like ours simply can't get a loan from banks. With Kinara Capital, you don’t even have to go anywhere, they come to you!”

Read Full Story

Ponnumony Kennedy

KVS Engineering Works

“Because I received timely help from Kinara Capital, I was able to deliver my orders on time and keep up the growth momentum of my…

Read Full Story

What is Machinery Purchase Loan?

Machinery Purchase loans, are a form of financing that aid business owners in the purchase of machinery or equipment. Business owners can speed up production, improve quality and reduce turnaround time that can help them service more orders and increase sales.

Main Documents Required for Machinery Purchase Loan

To apply for an machinery purchase loan from Kinara Capital, you will need the following documents:

• Applicant KYC (PAN required)

• Co-applicant KYC (PAN optional)

• Business KYC (PAN, Udyam etc.)

• Special License (e.g. Pollution NOC)

• Last 12 months of Bank Statements

• GST Return Filings (optional)

How can I utilize asset finance to grow my business ?

You can use an Machinery Purchase loan to purchase equipment if you own a business that requires specific machinery to operate, such as CNC machines, lathe machines, etc. These loans can help you expand your small business by increasing the production or operational capacity of your business.

How can I apply for a Machinery Purchase loan with Kinara?

You can apply now with myKinara app available on Android, or on our website. It takes only 1-minute to check your loan eligibility. You can also call us at our tollfree number 1800-103-2683 if you prefer requesting a local Kinara officer to visit you and help you complete the requirements.

What are the benefits of asset finance?

The primary benefit of asset financing is that it lends business owners the ability to invest in expensive machinery and equipment without breaking the bank. Machinery used in production and other business activities are typically specialized and can be prohibitively expensive, if you don’t plan ahead for the expense. Instead of compromising on other business activities or making a dent in your cash flows by spending out-of-pocket on machinery, you can opt for asset financing to make the purchase. Kinara Capital’s Machinery Purchase loans let you buy both new and used machinery and pay for them in easy installments.

How are assets used as collateral?

The process of pledging an asset to secure a loan is known as hypothecation. Kinara Capital doesn’t require any additional assets as collateral in order to issue a loan. Instead, in the case of Kinara’s Machinery Purchase loans, the machinery being purchased serves as a form of security. In this form of hypothecation, you will need to submit a machine purchase invoice and relevant documents when acquiring the loan. As long as you keep making your EMI payments in a timely manner till the loan is repaid, your ownership of the machinery will be completely secure.

FAQ

-

How quickly can I get a Machinery Purchase loan? What is the maximum amount possible?

-

Can I use a Machinery Purchase loan for any business expense?

A Machinery Purchase loan can only be used for the purpose of acquiring equipment or machinery needed for the operation of the business. For instance, a manufacturing business can utilize the loan amount for purchasing CNC machines. Kinara Capital’s Machinery Purchase loans can be used to buy both new and used machinery and equipment. However, no part of the loan amount can be allocated to other expenses, business-related or otherwise.

-

What are the steps for getting a Machinery Purchase loan via myKinara app?

myKinara app can take you through the process of acquiring a Machinery Purchase loan for your business with an easy 3-step process. First, check your eligibility in under a minute.

Once eligible, you will be guided through these steps:

Step 1: Personal and Business KYC

Step 2: Income Verification (e.g. bank statements)

Step 3: Loan Sanctioning and Disbursement (with eSigning) -

Will the machine I want to buy be hypothecated?

Yes, the machine is hypothecated for the issuance of an Asset Purchase loan. As long as you meet your EMI obligations, machine hypothecation will not occur. Machine purchase invoice and relevant documents will be required in exchange for the Asset Purchase loan.