To apply for a business loan, start by taking the 1-minute eligibility check . If you clear the business loan eligibility, you can then take the loan application forward by providing personal and business documents to complete the KYC process. Alternatively, one of our representatives will reach out to you to help you with the rest of the process. Now you can also download the myKinara app and take the eligibility check on it. If you qualify, you can complete the application process using the app.

Why choose Kinara Capital?

Get business loans from ₹1 lakh to ₹30 lakhs with a digital-first process in your preferred language. We serve 4,500+ pincodes and 300+ sectors.

Fast

Get your loan in 24 hours

Flexible

Minimal and flexible documentation process

Friendly

Doorstep customer service to help you from start to finish

Grow Fast with Business loans from us!

Kinara’s collateral-free business loans are aimed at providing fast access to funds for MSMEs. We provide doorstep customer service and our business loans process requires minimum documentation. Our fully digital process can go from loan decision-to-loan disbursement within 24-hours. Check your eligibility in a minute!

-

Tenure

12 - 60 months

-

Rates

Starts at 24%

-

1-30 lakhs

What is business loan?

Business loan is a form of financing that entrepreneurs can access to invest in their venture. Since capital is one of the most important elements required to start and run a business successfully, one of the top priorities of any entrepreneur is raising capital. However, the system is skewed against small business owners, since they typically start off with a small amount of capital, often out of their own savings. They also struggle to find funding from other sources. In such cases, loans can be extremely useful, but here too, small business entrepreneurs encounter a host of issues. Traditional lenders are risk-averse, and shy away from issuing loans to small businesses, which they consider to be high-risk.

Kinara Capital has stepped in to bridge this credit gap by providing fast, flexible and collateral-free loans to small business entrepreneurs. The loan can be used for various purposes such as expanding the business, buying more machinery, or covering day-to-day business expenses. These loan interest rate can vary depending on the purpose and tenure of the loan, as well as the lender’s policy and the borrower’s credit history. Kinara Capital’s online loans can be accessed quite easily and with minimal documentation within 24 hours.

How to apply for Business Loan?

You can apply for a it online with a 1-minute eligibility check. If eligible, a Kinara loan officer will get in touch with you as soon as possible to complete the rest of the requirements in your preferred language. Now you can also download the myKinara app and take the eligibility check on it. If you qualify, you can complete the application process using the app.

Why Should you Get Loan from Kinara Capital?

With a fully digital process, we can disburse loans within 24 hours. We have a hassle-free and transparent process to provide you support in your regional language during the entire process. Kinara Capital is an RBI registered company and we have successfully disbursed these loans to more than 36,000 MSMEs.

Benefits of Business Loans

It offer a range of benefits to entrepreneurs, including:

• They allow entrepreneurs to access the capital they need to expand their business, without worrying about falling short of funds.

• They facilitate making the most of business opportunities as they arise, like servicing large orders.

• Online loans from Kinara Capital have a very short turnaround time, and can help small business owners when they need capital in short order.

Features of Kinara Capital Business Loans

A Kinara Capital loan has the following features, which sets it apart:

• Unlike other loans, Kinara’s loans are completely collateral-free.

• The online business loan application process is quick and easy, and can be completed either by the customer themself or with the help of a Kinara representative.

• The business loan interest rate is applied on a reducing rate basis, and once the paperwork is completed, the loan can be disbursed in as little as 24 hours.

Eligibility Criteria for a business loan

To avail of a these loan from a particular lender, you must first ensure that you meet their basic eligibility criteria. These conditions vary from lender to lender, and in order to qualify for a business loan from Kinara, you need to meet the following criteria:

• Your business should be part of the manufacturing, trading or services sector.

• The pin code should be one where Kinara Capital is already offering services.

• Total monthly turnover should be greater than Rs. 50,000 and less than Rs. 2 crores.

• The business should fall under the list of sectors and sub-sectors serviced by Kinara.

Documents Requirement for a Business Loan

Traditional lenders like banks typically have a very intensive and tedious documentation process. However, new-age lenders like Kinara have come up with data-led ways to gauge creditworthiness, therefore reducing the need for extensive paperwork. Kinara has a simple and minimal documentation process, and offers the option to substitute certain documents for others, based on availability. To apply for business loan from Kinara Capital, you will need just the following documents:

• Applicant, co-applicant and business KYC documents (ID and address proof)

• Applicant’s PAN card

• Business registration document

• Last 12 months’ bank statements

Our Process

Get a business loan in

3 easy steps!

All you have to do is enter a few details and upload your documents to our secure online portal. We’ll take care of the rest!

-

-

Fast eligibility check

Find out if your business is eligible in just 1 minute! Available in 7 languages. Zero document upload required for eligibility check.

-

Secure KYC & income verification

Provide your personal & business documents. Fully secure online portal with easy upload. Help is at your fingertips with chat or call.

-

Quick loan disbursement

Get money in your account within 24 hours! Digital loan approval with electronic bank deposit.

-

Hear from our Happy Customers

Meet our VikasChampions

With their grit & perseverance, small business owners go on to create local jobs and grow India’s economy. Here’s what they have to say about us!

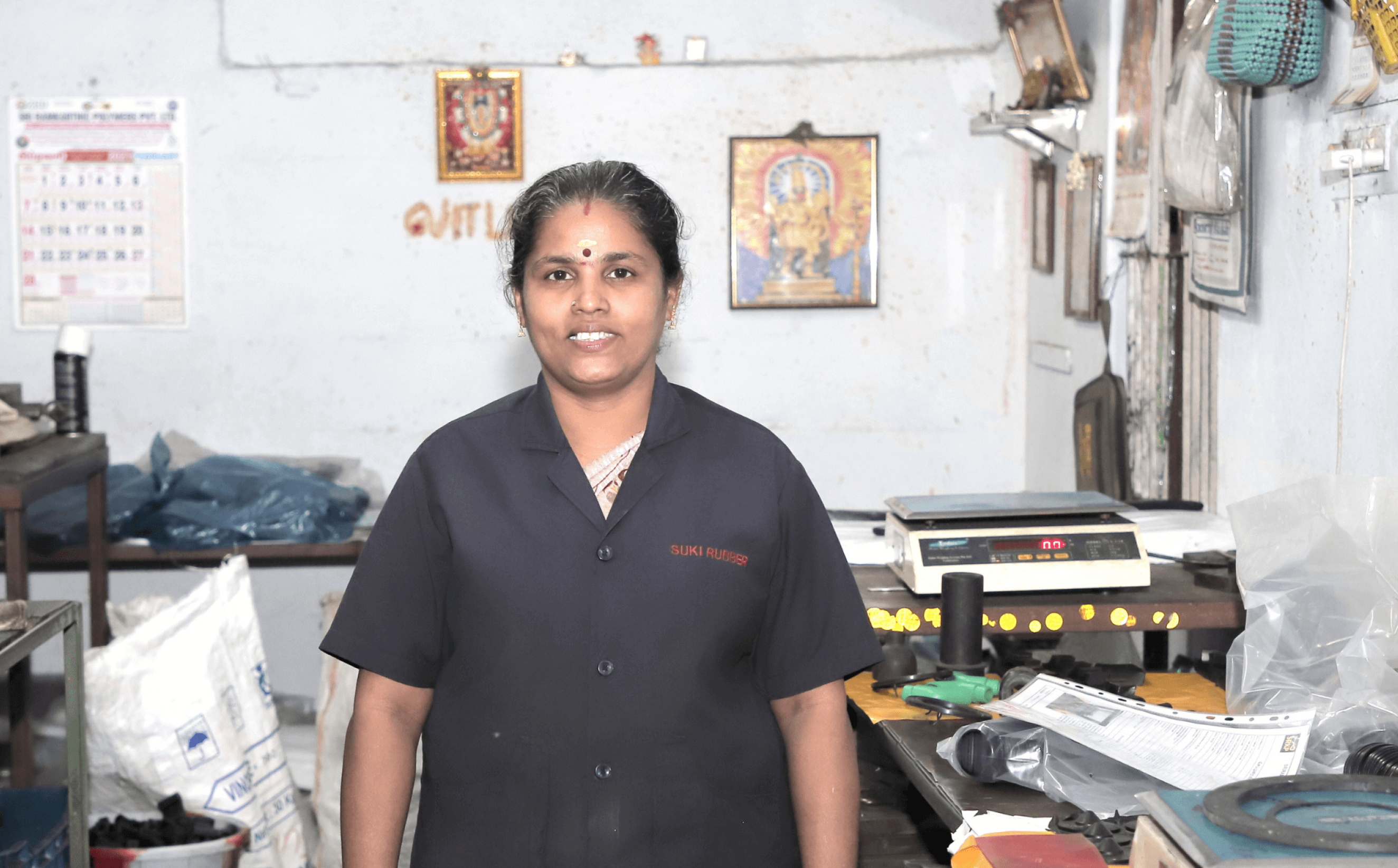

A.Geetha

Suki Rubber Products

“Kinara has supported me throughout. When I paid off my first loan, I was able to apply for another one and keep growing my business.”

Iswarya and Mohan Babu

Mukund Automats

“Once we got the first loan, we grew and grew. Our workforce also grew, we now employ 50 people! The most important factor in our growth and our success is Kinara Capital.”

Madagala Kanakaraju

Sri Sumangali Sweets and Bakery Andhra Pradesh

“When Kinara approached me, I couldn’t believe that they were willing to give us a loan. With their support, my business has grown by 35%.”

Nishit Shah

Nishit Tech

"Kinara supported me when I was in need of money for my small business. Since then, I've doubled my turnover & hired 4 new employees.”

Sivachandra R.

Sri Aarusuvai Food Products

“We took the loan and two subsequent ones from Kinara for buying machinery, which have been very helpful in running our business successfully”

Frequently Asked Questions

FAQ

-

How can I apply for a business loan on Kinara Capital?

-

What are the requirements to get a business loan?

-

Is there any age criteria to apply for a Business Loan?

-

How to check for Business loan status on Kinara Capital?

-

Can I get a Business Loan without collateral?

-

How can I speed up my business loan approval process?

-

What is an MSME business loan?

-

What is the typical loan approval time at Kinara

-

What are my options to repay a Business Loan?

-

How does a Business Loan affect taxes?

-

Who Can Take a Business Loan?

-

How do I know the status of my Business Loan application?

-

What is the minimum CIBIL score required for a business loan?

-

Which loan is best for business?

-

How can I qualify my business for an instant business loan?

-

Is there any restriction on the end use of my business loan?

-

What is the minimum turnover requirement for a business loan?

-

How easy is it to take a business loan in India?

-

What is the minimum loan amount for business?

-

What is the tenure for an instant business loan?

-

Can I use a business loan for working capital management?

-

How does a business loan affect my credit score?

-

When should you take a business loan?