Our tech-enabled application process and data-led decisioning process enables us to disburse easy business loans much faster and more efficiently than traditional lenders

Our Promise

Collateral-free Business Loans

Small Business Owners can get fast & flexible loans from ₹1 lakh to ₹30 lakhs with a digital-first process in their preferred language.

-

Loan Disbursement in 24-hours

-

Minimum Documentation for 300+ sectors

-

Doorstep Customer Service in 4,500+ pincodes

Our Products

Grow Your Business

with Kinara

We provide a range of business loans for MSMEs with a transparent and secure process.

-

HerVikas

Our HerVikas program offers an automatic discount to women entrepreneurs. No separate documentation required.

More Details- Raw Materials Purchase

- Stock Purchase

- Machine Purchase

- Machine Repair

- Business Premises Renovation

- General Business Expenses

- Supplier Payments

- Product / Market Expansion

-

Machinery Purchase

Buy a new or a second-hand machine to increase turnover and manufacturing productivity.

More Details- New Machine Purchase

- Second-hand Machine Purchase

-

Working Capital

Expand your business rapidly by financing your operations with flexible working capital loans.

More Details- Stock Purchase

- Business Premises Renovation

- General Business Expenses

- Invoice Financing

- Purchase Order Financing

- Product / Market Expansion

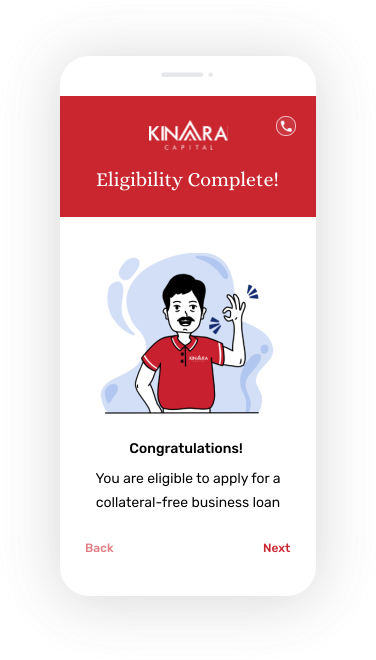

Our Process

Get myKinara

business loan in

3 easy steps!

All you have to do is enter a few details and upload your documents to our secure online portal. We’ll take care of the rest!

-

-

Fast eligibility check

Find out if your business is eligible in just 1 minute! Available in 7 languages. Zero document upload required for eligibility check.

-

Secure KYC & income verification

Provide your personal & business documents. Fully secure online portal with easy upload. Help is at your fingertips with chat or call.

-

Quick loan disbursement

Get money in your account within 24 hours! Digital loan approval with electronic bank deposit.

IMPORTANT: Do not give money to anyone for loan approval or loan processing. Kinara Capital representatives will NOT ask for a commission or payment to process your loan application. For any concerns, email us at [email protected].

-

Hear from our Happy Customers

Meet our VikasChampions

With their grit & perseverance, small business owners go on to create local jobs and grow India’s economy. Here’s what they have to say about us!

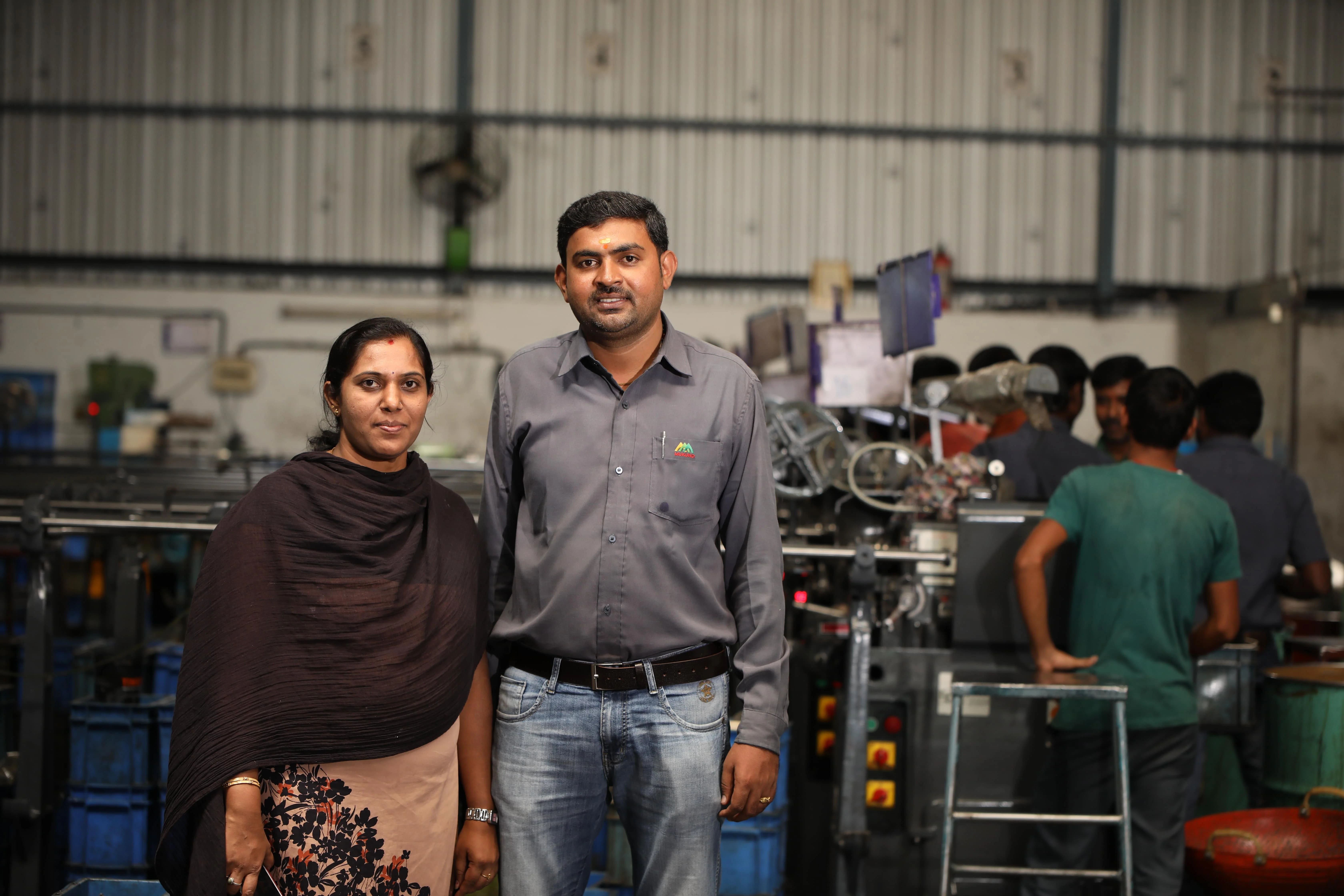

Iswarya and Mohan Babu

Mukund Automats

“After we got the first loan, we kept growing, and our workforce expanded to 50! Kinara has been the most important factor in our success.”

Read Full Story

Karthikeyan AS

ASK Three Star Steels

“We got the funding from Kinara to install a powder coating unit, which triple our turnover from Rs. 1 to Rs. 3 crores a year!”

Read Full Story

Vaishnavi

GainUp Designs

“Nobody was interested in giving us a loan in the early stages of the business except for Kinara. With the loan, we bought an imported…

Read Full Story

Amar Singh

Sai Balaji Electronics

“Kinara is like my best friend. With their support I have doubled my turnover and improved my life.”

Read Full Story Our Milestones

Our Milestones

-

4,000+ Cr

Loans Disbursed

-

50,000+

Happy Customers

-

133

Branches

-

250,000+

Jobs Supported

-

$100 Million

Generated for MSMEs

-

1 Million

Lives Impacted

About Us

Funding India’s Inspiring Small Business Entrepreneurs

We are a socially responsible fintech making it possible for small business entrepreneurs to bring economic prosperity in their communities with income generation and job creation.

Awards & Accolades

Our Recognitions

In The News

We are being noticed

Our voice and our work is often recognized for our commitment to financial inclusion.

April 11, 2022

Meet the winners of Women in AI Leadership Awards at The Rising 2022

Our Founder and CEO Hardika Shah is a winner at the "Women In AI Leadership…

Read MoreApril 1, 2022

FT ranking: Asia-Pacific High-Growth Companies 2022

Kinara Capital was featured in Asia-Pacific High-Growth Companies 2022. This fourth annual ranking of 500…

Read MoreApril 1, 2022

India’s Growth Champions return to the spotlight

Kinara Capital was featured in the Economic Times India’s Growth Champions 2022 list for the…

Read MoreApril 1, 2022

Meet the Fintechs in Financial Times’ Top 500 High-Growth APAC Companies

The article highlights the Financial Times' fourth annual ranking of growth champions in Asia-Pacific (APAC).…

Read MoreMarch 25, 2022

What Is Loan Against Collateral And How To Get One?

In an exclusive article, our Founder and CEO, Hardika Shah shares insights on how to…

Read MoreFeatured in :