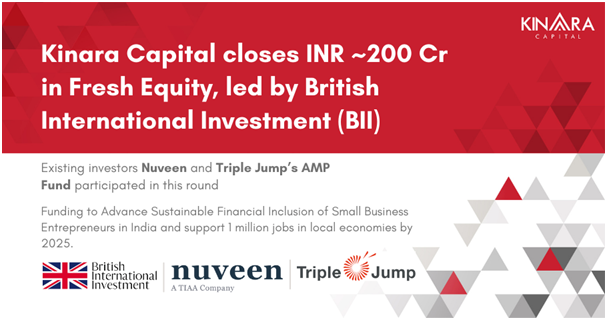

Kinara Capital has added another milestone to its fundraising journey by attracting British International Investment (BII), the UK’s premier development finance institution and impact investor, on board as an equity investor. Kinara, one of India’s fastest growing fintech for MSME entrepreneurs today announced the closing of a fresh INR 200 crore equity round led by BII, with participation from existing equity investors Nuveen and the ASN Microkredietfonds advised by Triple Jump.

Alex Ellis, British High Commissioner to India, said: “Women-led fintech company Kinara champions female empowerment and provides easier access to capital for small entrepreneurs across India. The British Government is proud to support the company through BII’s investment. The UK remains committed to solving the biggest global development challenges by supporting sustainable and inclusive economic outcomes for all.”

The latest round of equity investment will help Kinara Capital grow 5x by 2025 to INR 6,000 crores in AUM by democratising access to formal financial inclusion through its myKinara App, which is driven by powerful AI/ML and can take MSMEs from loan decisions to payout in less than 24 hours. The social impact of this expansion is estimated to support 1 million jobs in local economies and create over INR 3,000 crores in incremental income for small business operators. Kinara plans to reach over 200,000 MSMEs in 100+ cities over the next three years.

Hardika Shah, Founder & CEO, of Kinara Capital, said, “We are honoured to onboard British International Investment (BII) as our latest equity investor. The combined expertise and capital infusion from BII, Nuveen and Triple Jump, will expand Kinara Capital’s offerings to meet the rising demand of the MSME sector in India. This year, India’s GDP growth has exceeded pre-pandemic levels signifying the resilience and growth prospects of small business entrepreneurs. With this support, we, at Kinara Capital, are further motivated to deliver on our mission of financial inclusion.”

Kinara qualifies for the 2X Challenge, a G7 initiative to deploy and mobilise capital to support projects that empower women as entrepreneurs, business leaders, employees, and consumers, of which BII is a founding member. The company’s HerVikas initiative offers an automatic discount to all female entrepreneurs to promote gender parity in the MSME sector. The company also adheres to international Environmental, Social, and Governance (ESG) standards for financial service providers, specifically the International Finance Corporation Performance Standards (IFC PS), Client Protection Pathway (CPP), United Nations Women Empowerment Principles (UN WEP), and maps to United Nations Sustainable Development Goals (UN SDGs).

BII is the new name for the UK’s development financing institution, which was previously known as CDC Group. BII is owned entirely by the UK Government, with the Foreign, Commonwealth & Development Office (FCDO) as its only shareholder. The FCDO functions as the country’s ministry of foreign affairs, with one of its main objectives being reducing poverty and tackling global challenges in conjunction with their international partners. BII company is an important part of the UK Government’s wider plan to mobilise up to £8 billion in public and private sector investment in international projects by 2025. The company has £7.7 billion in assets and over 1,300 investments in emerging economies.

On partnering with Kinara, Manav Bansal, Managing Director and Head of India, BII, commented, “BII seeks to invest in companies that demonstrate strong development impact capacity and offer tech-enabled innovative solutions with high potential for scalability. Kinara Capital meets these criteria, and we are especially excited by its commitment to expanding financial inclusion to MSMEs, including increasing women’s access to business finance which in turn promotes women’s entrepreneurship. I am pleased that our flexible capital is helping to boost productivity within India’s MSME sector and facilitate entrepreneurial growth that will continue to transform the nation’s economy.”

Nuveen and Triple Jump, two of Kinara’s existing investors, participated in this equity fundraiser led by BII. Nuveen, TIAA’s investment manager, offers a wide range of outcome-focused investment solutions designed to ensure institutional and individual investors’ long-term financial goals. As of June 30, 2022, Nuveen had $1.1 trillion in assets under management and operations in 27 countries. Its investment specialists offer in-depth knowledge of a wide array of traditional and alternative assets through a diverse set of vehicles and bespoke strategies.

Triple Jump is a Dutch impact-focused investment manager that offers meaningful and responsible investing possibilities in emerging markets. Triple Jump funds manage and advise businesses that focus on financial inclusion, affordable housing, missing middle finance (SMEs), and climate and nature. The ASN Microkredietfonds is a listed and regulated microfinance investment fund that invests in financial inclusion in Africa, Asia, Europe, and Latin America.

Earlier this year, Kinara Capital raised INR 380 crores in funding in an equity round led by Nuveen, with participation from Triple Jump. This investment has helped the company scale faster to meet the rapidly rising MSME credit demand in India. These two well-recognized investors coming on board for the second round of funding for Kinara Capital signals the potential the company holds, both in terms of impact and profitability.

Kinara has a strong track record for attracting investments from noted impact investors. Gaja Capital, GAWA Capital, Michael & Susan Dell Foundation (MSDF), and Patamar Capital are among Kinara Capital’s other major equity investors. Edelweiss Financial Services Limited served as the exclusive advisor on the transaction.This latest round holds a lot of promise for the company, both in terms of funding and forging an important new partnership.