While you may rely on your own funds to start your business, you do not have to meet all of your business’s needs out of your pocket. A business loan is one way we can help your business grow and even meet your initial operating costs.

Especially in our country’s economic powerhouse – Mumbai, getting a business loan can prove to be of great help considering the tight competition in the market. It has the fourth-highest concentration of small businesses in India and an 8 per cent share of India’s 6.3 crore MSME base. However, Mumbai is yet to see a complete turnaround of small businesses that have been falling short due to a shortage of manpower, capital, or a broken supply chain.

Cotton textiles, chemicals, machinery, electricals, transportation, and metal works are the state’s six most important industries. Whatever your industry may be, taking business loans in Mumbai can ensure that your capital requirements and operating expenses are met in the most efficient way possible.

The primary goal of taking a business loan is to meet the pressing needs of your expanding business. To meet an established company’s business needs, we at Kinara Capital offer flexible business loans in Mumbai.

The most important reason for seeking a small business loan is to invest in your company’s growth potential. It will also provide you with an opportunity to respond to market demand in competitive cities like Mumbai.

Businesses become more stable as they grow. So, calculate the potential increase in sales following your expansion plans. Will the sales cover the loan’s cost while still making a profit? This way, you can determine whether taking business loans in Mumbai is feasible for your company.

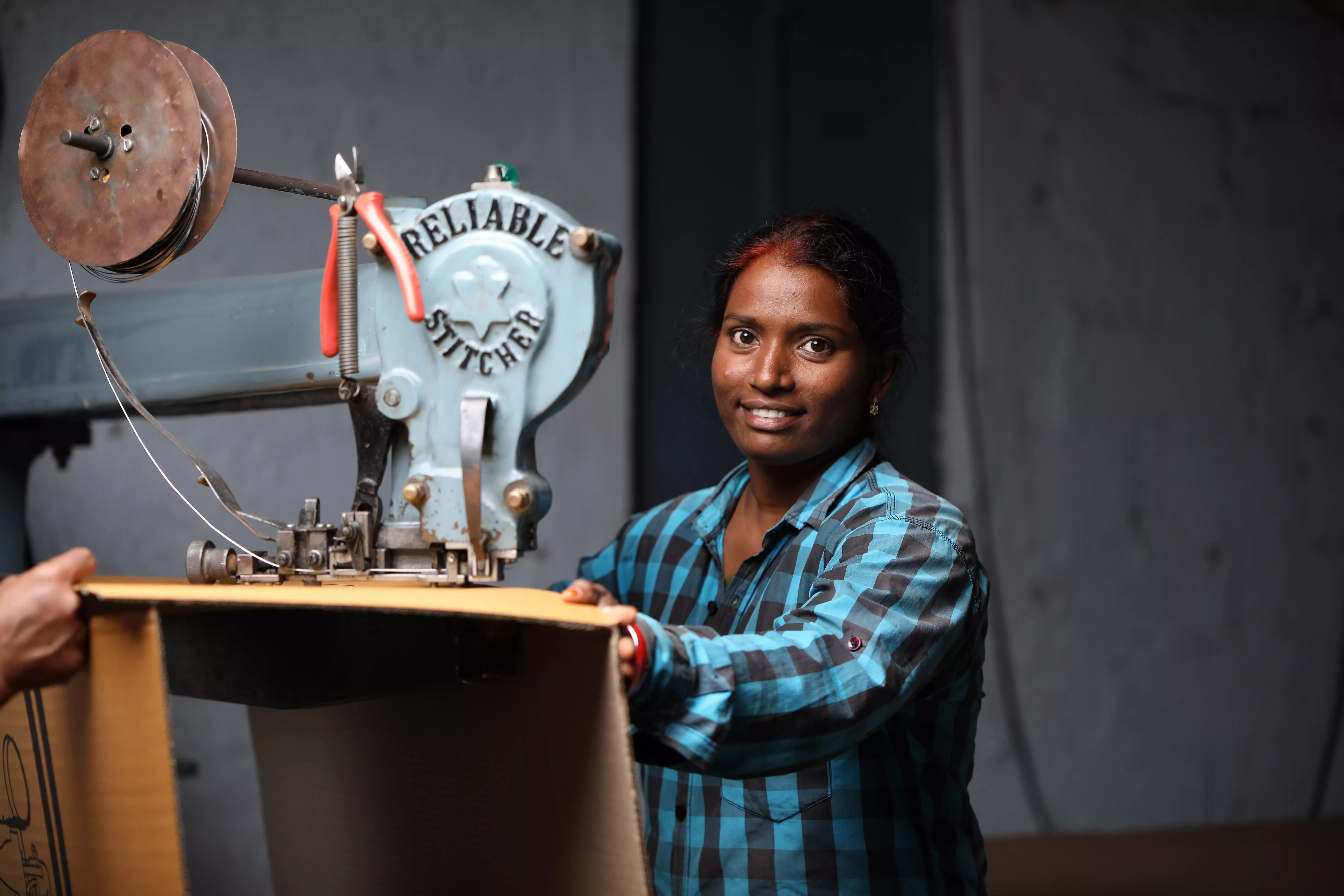

Purchasing equipment that will improve your company’s turnover is usually a no-brainer in terms of financing. However, you require machinery, or other tools to manufacture your product or provide your service according to your industry. For that, you require a loan to finance that equipment.

At Kinara Capital, we offer an asset purchase loan to help you increase your small business’s turnover without the need for collateral.

Owning a small business requires you to wear many hats. However, there comes a point when doing the bookkeeping, fundraising, marketing, and customer service may become too much for you and your business. If your small team is juggling too many tasks, something will fall through the cracks and jeopardize your business.

At Kinara Capital, we assist you in obtaining business loans in Mumbai and growing your existing small business. We offer MSMEs collateral-free business loans. Fill out our 1-minute online eligibility check, and if you are qualified, our loan officers will contact you to guide you further. Our loan application process is completely online and is as simple as it gets with minimal documentation required.

We believe that with the will and perseverance, any small business can achieve heights and grow our country’s economy. We take pride in calling ourselves a social enterprise, which takes the much-needed steps towards creating a change. Unfortunately, as many small businesses still get denied business loans from banks, we believe that MSME owners are the real heroes of our country.

One of our customers’ Vaishnavi from GainUp Designs, shared her experience of getting a loan from us and how it supported her in expanding her small business. Kinara Capital provided her with a business loan from which she could buy an imported machine. This significant investment along with her never-say-die spirit further helped her gain new buyers and exporters. She witnessed how taking a business loan in Mumbai can help support and strengthen small businesses.

So, understand the importance of financial support and give your small business the required push for the greater good with Kinara Capital!