Kinara Capital, a registered brand of Kinara Capital Private Limited (formerly known as Visage Holdings and Finance Private Limited), is a fintech driving financial inclusion of India’s small business entrepreneurs (MSME sector). With its unique blend of tech-enabled processes and doorstep customer service, Kinara Capital leads with the best approach to deliver fast access to formal business credit. The company’s myKinara App is multilingual and the company offers omnichannel customer service. Kinara Capital operates from 133 branches in six (6) states in India servicing 4,500+ pincodes in Tamil Nadu, Karnataka, Andhra Pradesh, Telangana, Gujarat, Maharashtra, and the Union Territory Puducherry. The Company is headquartered in Bengaluru, Karnataka. Kinara Capital is qualified as a Systemically-Important Non-banking Financial Company (NBFC) by the Reserve Bank of India (RBI) and is a debt-listed entity on the Bombay Stock Exchange (BSE).

Kinara believes that businesses should be managed in a sustainable manner giving due credence to human rights, environment, the community, and the people working for the businesses. Through its operations, Kinara is driven to make its own contribution in enabling a sustainable world.

Kinara recognizes that its own activities and those of its borrowers have the potential to cause both, adverse and beneficial environmental, social and governance (ESG) impacts. The adverse impacts, if left unaddressed, could translate to credit risks, legal risks and/or reputational risks in the long term. Engagements with the borrowers also present opportunities through down-side risk management and upside value creation in terms of brand differentiation, portfolio performance, stronger relations, and increased loyalty. Kinara is cognizant of the role it can play in influencing MSMEs towards adopting environmentally friendly practices and respecting human rights.

With this background, Kinara has developed an Environmental, Social and Governance Management System (“ESG-MS”) to address ESG risks and opportunities in a structured manner commensurate with the scope and scale of its own and borrower operations. The ESG-MS is guided by Kinara’s ESG Policy and Principles that are aligned with the national and relevant international ESG safeguards to identify, assess, manage, and monitor the ESG risks and enhance opportunities in its business

The ESG-MS has been developed with reference to the following frameworks:

- Applicable local, national and international environmental and social legislation, including occupational health and safety

- International Finance Corporation Performance Standards (IFC PS 1-8)

- The World Bank Group General Environmental, Health and Safety (EHS) Guidelines

- CERISE+SPTF Client Protection Standards

- CERISE+SPTF Client Protection Pathway (CPP)

- CERISE+SPTF Universal Standards for Social and Environmental Performance Management (SEPM)

- British International Investment (BII) Policy on Responsible Investment

- International Labour Organization (ILO) Conventions

- United Nations Sustainable Development Goals (UN SDGs)

- United Nations Women Empowerment Principles (UN WEP)

- United Nations Principles for Responsible Investment (UN PRI)

- United Nations Environment Programme for Financial Institutions (UNEP-FI)

- United Nations Global Compact (UNGC)

- Task Force on Climate related Financial Disclosures (TCFD)

- European Development Finance Institutions (EDFI)

- Greenhouse Gas (GHG) Protocol / India GHG Program

- Global Reporting Initiatives (GRI)

- Science Based Target Initiative (SBTi)

- Orange Bond Initiative

- Financial Action Task Force (FATF)

- European Union (EU) 5th Anti-Money Laundering Directive (5AMLD)

4.1 Our ESG Vision & Policy Statement

Through its ESG Policy, Kinara makes a commitment towards contributing to a more sustainable world by taking measures at the appropriate stages to address ESG risks and opportunities in its business operations

Kinara Capital ESG Vision

Our commitment to Environmental, Social, and Governance principles is to incorporate environmental sustainability and social well-being as we create equitable access to financial services for small business entrepreneurs in India. ESG includes initiatives such as:

- Supporting Local Economies w/Financial Inclusion

- Excluding harmful sectors from our funding focus

- Advocating for Gender Parity for employees & customers

- Building awareness of how to reduce energy consumption practices

- Providing safe & healthy working conditions for employees across all office locations

Kinara Capital ESG Policy Statement

Kinara Capital was founded with the mission to transform lives, livelihoods and local economies by providing fast and flexible loans without collateral to small business entrepreneurs in India. We believe that maintaining an environmental and social balance is key to a sustainable economy.

We are committed to conduct its business in an environmentally sensitive, climate conscious, socially responsible, fair and transparent manner. In line with our commitment, we have developed an ‘Exclusion List’ of sectors to which we will not extend business loans.

In our own operations and in our borrower operations, we will create sensitization on providing employment that is inclusive, gender-responsive, and safe; respect of human rights, conservation of natural resources, generation of low wastes and emissions to protect the environment.

We will comply with all relevant Indian national environmental and social legal requirements and those asked by our partners, on a proactive basis, and encourage borrowers to follow suit.

We are committed to comply with our ESG-MS Policy and will implement appropriate procedures and build organizational capacity to achieve our policy objectives.

4.2 ESG Operational Principles

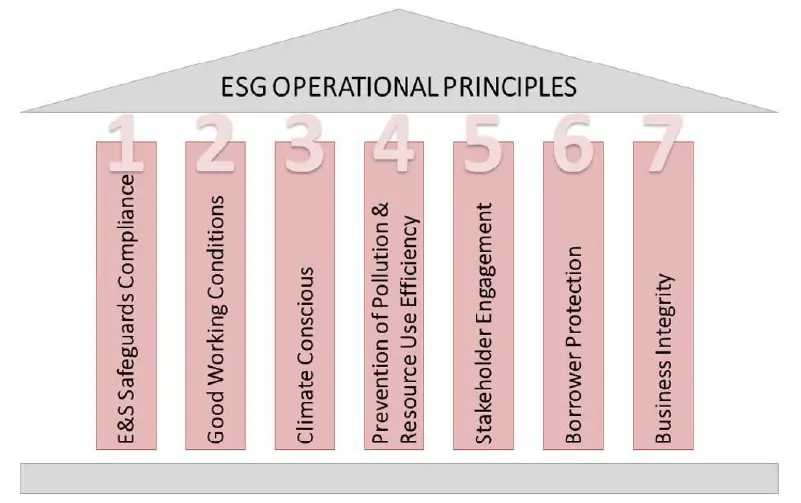

The ESG Policy Statement will guide the ESG performance of Kinara and is implemented through the ESG Operational Principles that are applicable to Kinara’s own operations and its borrowers, as relevant. A snapshot of the ESG Operational Principles is presented in Figure 1.

Figure 1: ESG Operational Principles

- Compliance with ESG Safeguards in Kinara and influencing borrowers to comply:

- Applicable local, national and international environmental and social legislation, including occupational health and safety

- International Finance Corporation Performance Standards (IFC PS 1-8)

- World Bank Group General Environmental, Health and Safety (EHS) Guidelines

- CERISE+SPTF Client Protection Standards

- CERISE+SPTF Client Protection Pathway (CPP)

- CERISE+SPTF Universal Standards for Social and Environmental Performance Management (SEPM)

- British International Investment (BII) Policy on Responsible Investment

- International Labour Organization (ILO) Conventions

- United Nations Sustainable Development Goals (UN SDGs)

- United Nations Women Empowerment Principles (UN WEP)

- United Nations Principles for Responsible Investment (UN PRI)

- United Nations Environment Programme for Financial Institutions (UNEP-FI)

- United Nations Global Compact (UNGC)

- Task Force on Climate related Financial Disclosures (TCFD)

- European Development Finance Institutions (EDFI)

- Greenhouse Gas (GHG) Protocol / India GHG Program

- Global Reporting Initiatives (GRI)

- Science Based Target Initiative (SBTi)

- Orange Bond Initiative

- Financial Action Task Force (FATF)

- European Union (EU) 5th Anti-Money Laundering Directive (5AMLD)

- Good Working Conditions and Fair Labour Practices at Kinara and influencing borrowers to comply with labor laws by:

- Not employing child labour or forced/ penalty labour.

- Preventing gender based violence and harassment at the workplace.

- Providing safe and healthy workplaces and mitigating health impacts related to the work.

- Treating all employees fairly and equally in terms of recruitment, remuneration and progression irrespective of gender, race, background, language, disability, political opinion, age, religion.

- Remunerating employees and paying social benefits in a fair manner.

- Encouraging employees to share ideas and thoughts to the management through regular consultations and open door culture.

Note: Employees means workers directly engaged as well as contracted workers engaged through third parties

- Being Climate Conscious:

- Kinara is working to achieve net zero operations and value chain emissions by investing in the continued reduction of our operations by 2050, and in the development of a net zero pathway for the emissions from our value chain by 2050.

- Kinara is committed to aligning its financing with the goals and timelines of the Paris Agreement.

- Kinara is providing the green and sustainable finance required to transform the economies and clients we serve and are determined to play our part as ESG Coordinator, ESG Assessments and more into ESG financing.

- Promoting Prevention of Pollution and Resource Use Efficiency for environmental protection and conservation by influencing borrowers to:

- Adopt appropriate controls (where relevant), including processes and procedures to manage pollution generated in the form of air emissions, wastewater generation and solid waste generation through treatment, destruction, or disposal in an environmentally sound manner.

- Minimize pollution generation through source reduction of waste volumes.

- Reduce material and energy inputs, avoiding use of hazardous materials, improving process efficiencies and safety and minimizing waste generation

- Identify opportunities to reuse, recycle and recover resources from the wastes/emissions generated

- Engaging with Stakeholders:

- Not discouraging employee associations and providing opportunity to present their views to the management through dialogue

- Establishing customer feedback mechanism and analysing inputs for service improvement

- Reporting to relevant stakeholders in a planned manner

- Borrower Protection:

- Designing financial products that are affordable, flexible and suiting borrower interests, excluding waiver of borrower rights under host country law.

- Preventing over-indebtedness by performing adequate due diligence on the borrower’s repayment capacity, and designing appropriate loan repayment schedules and using collaterals and guarantees judiciously

- Communicating necessary information about the product clearly, timely and in a language understood by the borrower

- Pricing the product affordable to borrowers while allowing the financial institution to be sustainable

- Conveying in writing in a language understood by the borrower, by means of a sanction letter, the loan is sanctioned along with the terms and conditions including the rate of interest and the method of application.

- Treating borrowers fairly and respectfully, free of discrimination through code of ethics for staff, incentivizing good client relations and responsible use of agents.

- Respecting individual client data in accordance with host country law and regulations and implementing appropriate mechanisms to maintain client confidentiality on personal data.

- Maintaining Business Integrity:

- Adopting and maintaining a whistleblowing mechanism proportionate to the risks in the business.

- Ensuring that employees and third parties representing the business do not engage in bribery and corruption.

- Not engaging in money laundering practices and any financing of terrorism.

- Establishing mechanisms to counter fraud and cyber security.

The ESG Policy and Principles have been presented to the Board and are duly approved. The policy shall be applicable from the date of the Board approval, i.e., August 07, 2024 to all Kinara own and borrower operations.

The ESG Policy shall be prominently displayed in all Kinara offices (head office and branches) and communicated to all employees through training programs. It shall also be communicated to other relevant stakeholders, such as investors, shareholders, business partners as relevant. The ESG Policy shall be made available to all other concerned stakeholders on Kinara’s website.

The ESG Policy Statement and Operational Principles is supported by an Environmental, Social and Governance Management System (ESG-MS). The ESG-MS has been formally adopted by the top management to operationalize the ESG Policy in the business.

Under the ESG-MS, the procedures and tools for ESG risk and opportunity identification, management and monitoring have been developed and integrated with the loan cycle. The institutional structure with roles and responsibilities of various departments towards implementation of the ESG-MS have been defined.

The ESG Policy and underlying procedures will be reviewed on an annual basis by the E&S Committee, to ensure its continuing suitability, adequacy and effectiveness.