If you are a small business owner looking for an MSME business loan, we are here to help you. We have a 1-minute eligibility check on our website, post which a Kinara loan officer will get in touch with you. Our Loan Officer will continue with the process in your desired language and walk you through the process.

Why choose Kinara Capital?

Get MSME loans from ₹1 lakh to ₹30 lakhs with a digital-first process in your preferred language. We serve 4,500+ pincodes and 300+ sectors.

Fast

Get your loan in 24 hours

Flexible

Minimal and flexible documentation process

Friendly

Doorstep customer service to help you from start to finish

Collateral-free MSME Loans

We provide doorstep customer service in Gujarat and our loan process requires minimum documentation. Our fully digital process can provide you a loan within 24-hours.

-

Tenure

12 to 60 months

-

Rates

Starts at 24%On a reducing rate basis

-

1-30 lakhs

Unsecured business loans in Ahmedabad

Ahmedabad is known as the textile hub of India. It has emerged as an important centre of business because of cotton production and related industries developed in the city. It is among the 100 cities being developed as Smart Cities by the Indian government. It has therefore been in focus and has received several administrative and financial boosts from the government in terms of infrastructure development. Aside from textile, Ahmedabad also houses other industries. With so many opportunities to grow, small businesses in Ahmedabad need access to capital, but might not be able to acquire it from traditional lenders like banks. Banks are usually risk averse and ask for extensive documentation and property collaterals. Kinara Capital, on the other hand, provides unsecured business loans in Ahmedabad.

Business Loans in Gujarat

Gujarat is one of the wealthiest states in the country, and also among the leaders in terms of infrastructure and a developmental push from the government. In fact, the state is home to 6 of the 100 smart cities being developed by the government. Gujarat is one of India's most industrialized states, and houses a wide variety of industries. The major of these are textile and apparel manufacturing, gems and jewellery making, vegetable oil production, production of chemicals and cement. There are also petrochemicals and fertilizer manufacturing units across the state. There are thousands of small businesses and manufacturing units in the state, but they may not have easy access to capital because of the risk aversion of traditional lenders. Such businesses can turn to Kinara Capital, which offers quick and easy business loans in Gujarat.

How to get a business loan in Ahmedabad?

Small business owners based in Ahmedabad might find themselves being turned away by banks if they approach them for a business loan. This might result in such businesses missing out on growth opportunities. However, there is an easier way to get MSME loans in Ahmedabad. Log on to the Kinara Capital website and fill out our 1-minute eligibility check to see if you qualify for a loan. If you do, a loan officer will get in touch with you to complete the process. The MSME loan process at Kinara Capital is quick, easy and requires minimal

Supporting your growth

Micro-Small-and-Medium Enterprises (MSMEs) in India suffer from the lack of access to formal credit. Kinara uses a mobile-first approach to help over 300+ MSME sectors without having to provide property collateral or security against it. These business loans can be utilized by small businesses for a range of purposes, from paying salaries to procuring stock or raw materials to machine repair or buying a new machine.

Our Process

Get a business loan in

3 easy steps!

All you have to do is enter a few details and upload your documents to our secure online portal. We’ll take care of the rest!

-

-

Fast eligibility check

Find out if your business is eligible in just 1 minute! Available in 7 languages. Zero document upload required for eligibility check.

-

Secure KYC & income verification

Provide your personal & business documents. Fully secure online portal with easy upload. Help is at your fingertips with chat or call.

-

Quick loan disbursement

Get money in your account within 24 hours! Digital loan approval with electronic bank deposit.

-

Hear from our Happy Customers

Meet our VikasChampions

With their grit & perseverance, small business owners go on to create local jobs and grow India’s economy. Here’s what they have to say about us!

Nishit Shah

Nishit Tech

"Kinara supported me when I was in need of money for my small business. Since then, I've doubled my turnover & hired 4 new employees.”

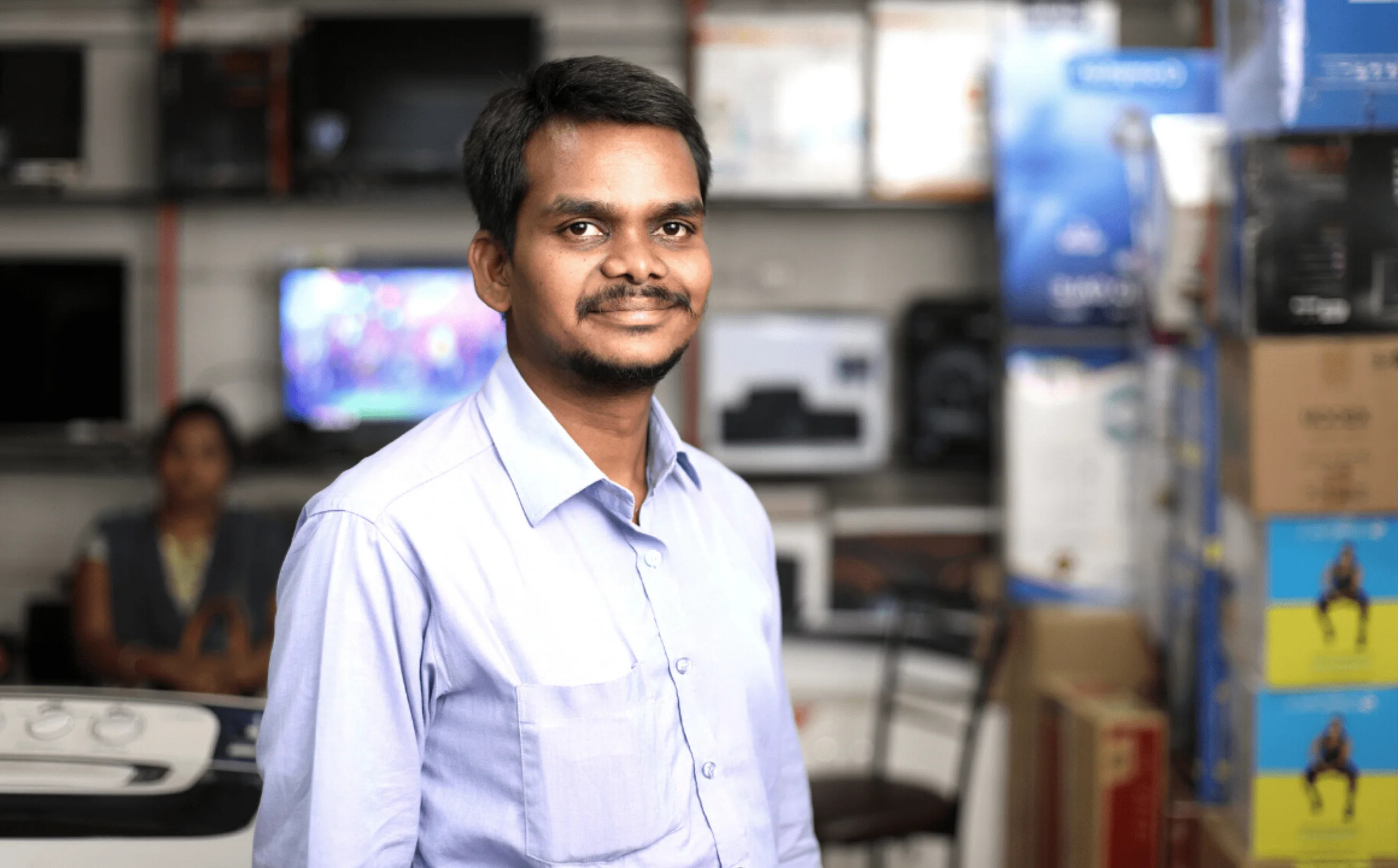

K. Appa Rao

Hema Electronics

“With Kinara's support, I kept my business running smoothly and growing in leaps and bounds. Now I’m helping others by creating jobs.”

Vishwanathan

Sri Sai Candles

“Small factories like ours simply can't get a loan from banks. With Kinara Capital, you don’t even have to go anywhere, they come to you!”

Frequently Asked Questions

FAQ

-

How to apply for a business loan in Ahmedabad?

-

Is Kinara Capital a bank?

-

What is the eligibility criteria for an unsecured business loan in Ahmedabad?

-

Is the business loan process lengthy?

-

Is Kinara Capital registered with/regulated by the RBI?