-

5,000+Cr

Loans Disbursed

-

4,500+

Pincodes

-

300+

MSME Sub-Sectors

What We Believe

Our Mission

Kinara Capital transforms lives, livelihoods and local economies by providing fast and flexible loans without collateral to small business entrepreneurs in India.

Our Vision

Kinara Capital envisions a financially inclusive world where every entrepreneur has equal access to capital.

Our Leadership

Our visionary leadership team is building innovative solutions to support the underserved MSME entrepreneurs

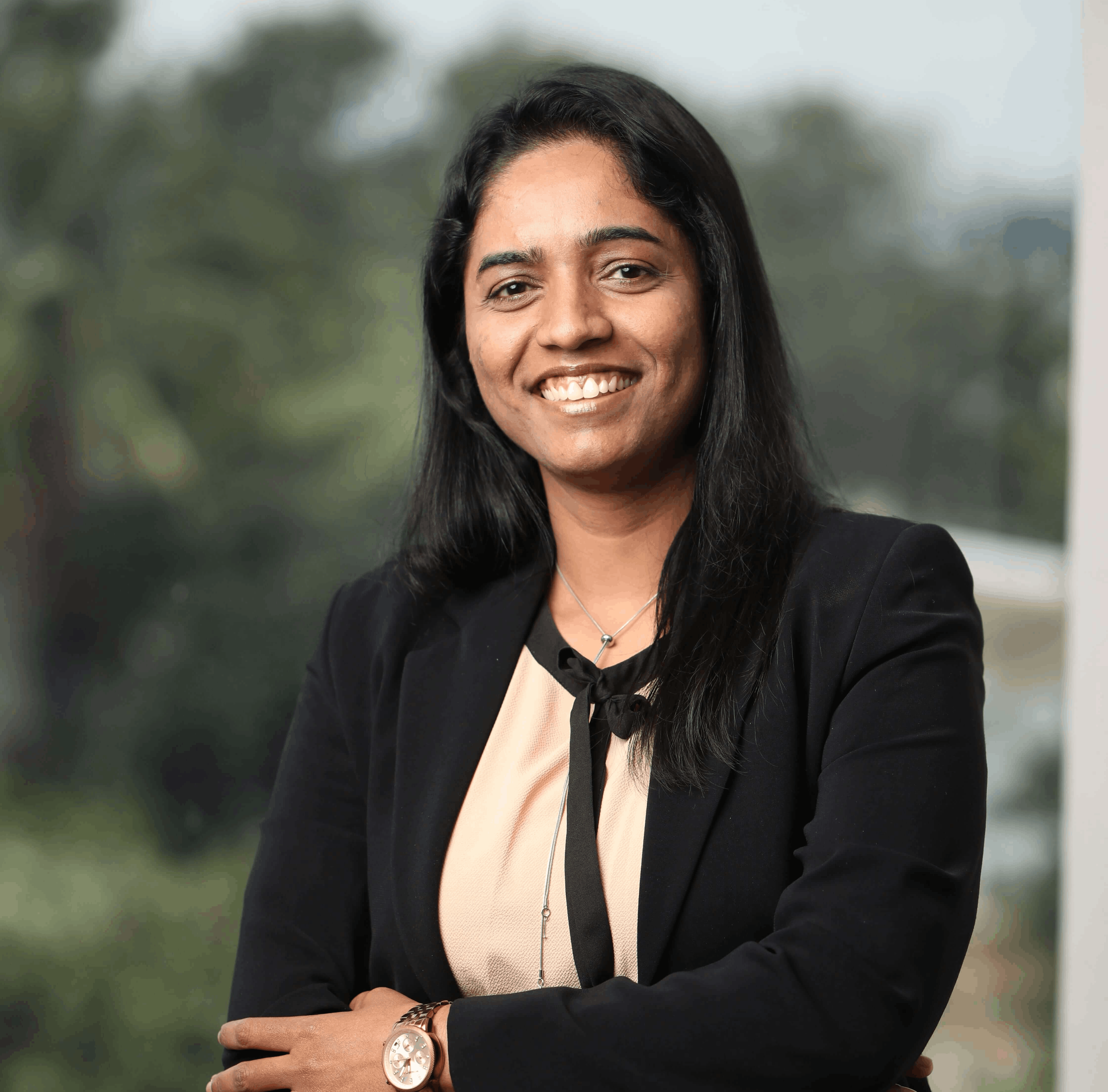

Our Management

Our women-majority leadership team is dedicated to the vision of inclusivity and growth.

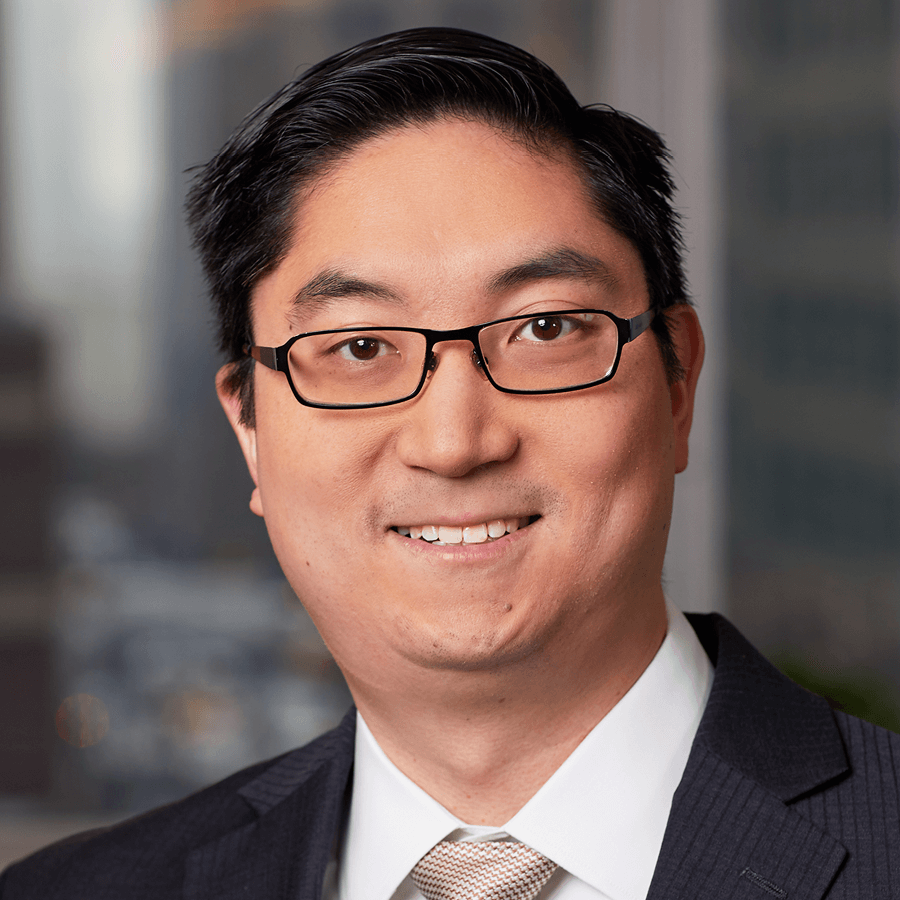

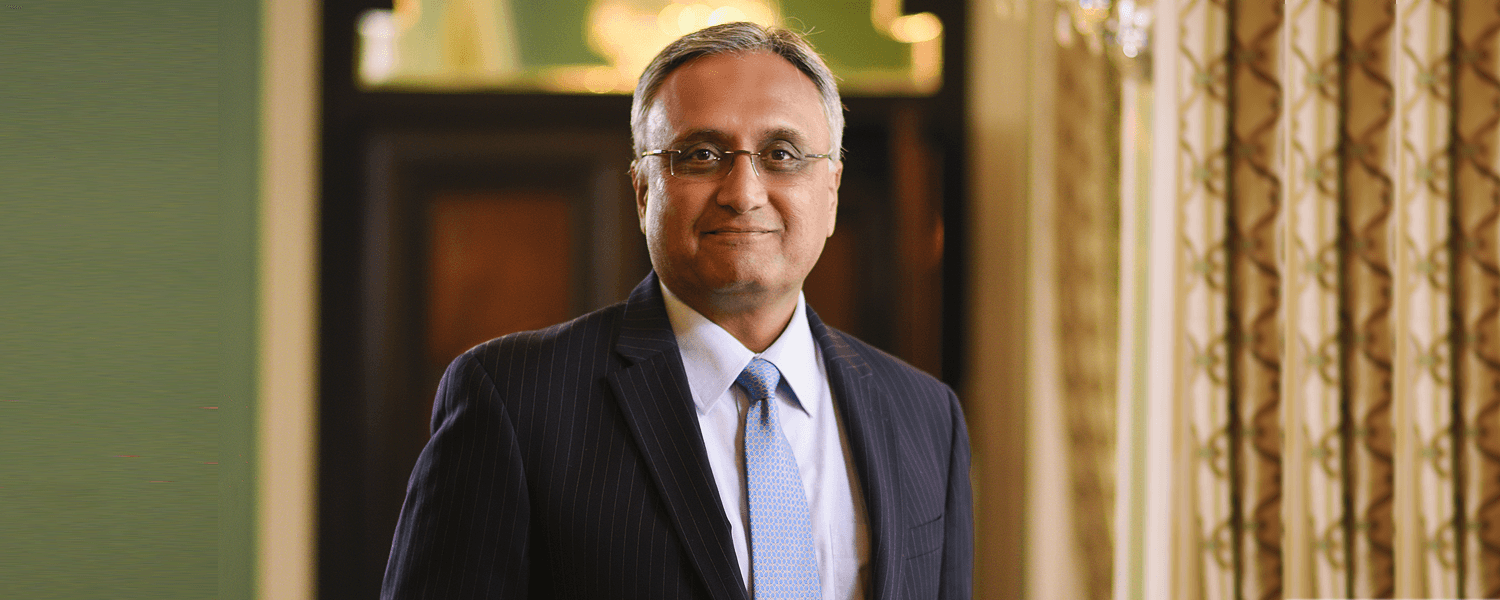

Board of Directors

Our Board Members are passionate about creating an impact in the world’s fastest growing economy.

Our investors

Our investors believe in us to create sustainable impact with financial inclusion of small business entrepreneurs.

Our Recent Partners

Our partners share our vision of providing capital access to the last-mile borrower, and together we form an ecosystem of sustainable growth.

Our partners share our vision of providing capital access to the last-mile borrower, and together we form an ecosystem of sustainable growth.

Kinara Capital is a registered brand of Kinara Capital Private Limited

(formerly known as Visage Holdings and Finance Private Limited)

Get in touch

- [email protected]Email

- 1800 103 2683Toll Free

Monday - Friday | 9.30AM - 6.00PM