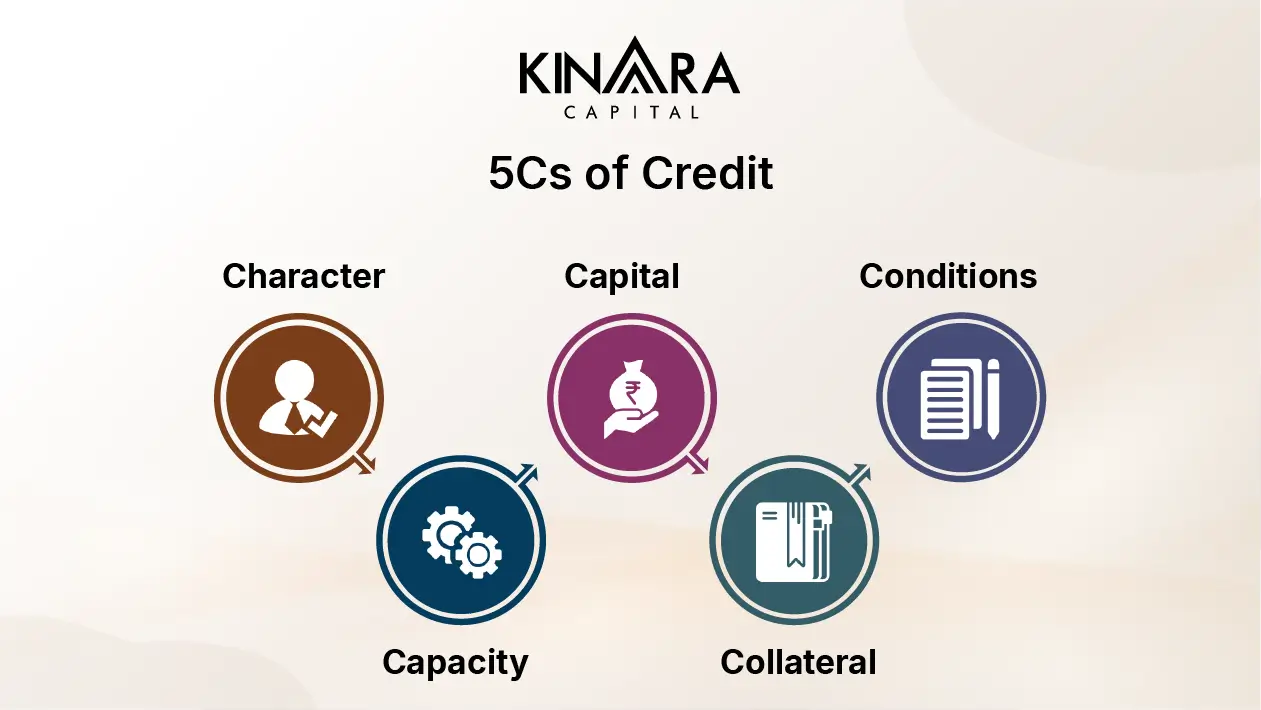

The 5 C in credit, when applying for a business loan, makes all the difference. Lenders use these 5 C’s for credit – capacity, capital, condition, and collateral to verify if your business is a reliable candidate for credit. By following these factors, you can build a strong application and successfully get a loan. In this blog, we will be learning about the five C’s of credit, its importance, and how it helps in securing your business funding.

Lenders check the five C’s of Credit to see whether borrowers are capable of paying loans back. Character, Capacity, Capital, Conditions, and Collateral help lenders make informed and smart choices when looking at credit. Let’s explore each ‘C’ in detail.

Character determines the dependability and trustworthiness of a borrower in retiring the debt. Of the five C’s, this is one of the most observed things by lenders. The lender does a credit analysis of a borrower, such as loans taken in the past and how they were retired to see how responsible and dependable he has been. Good credit history and repayment experience show the creditor that this new loan is most likely to be returned on time. It is very experience of the borrower and his business reputation build up the confidence of the lender.

Capacity looks at the ability to repay by analysing the income and debt status. The lenders review financial statement, cash flow, and debt-to-income ratios to verify the borrower has the capacity to afford the increase in debt. It reveals if a company has adequate cash flow to retire its debt. The companies that have high profitability, reasonable debts, and security will more easily get the loan approval as that reflects good financial health.

Capital, in 5 C’s of credit, refers to the cash that has been put into a business by a borrower. The lending institutions like it when the borrower has used personal cash in the company. This makes them committed to a lesser risk of default. A very good capital investment provides cushioning for the business and proves the borrower has interest in the success of the business. Lenders view a large personal or business investment as an indication that the borrower is less likely to default on the debt.

Conditions refer to the loan’s terms and conditions and the economic environment surrounding the business. They look into other factors like the rate of interest being charged, the amount lent, and the specific reason for borrowing. They also regard overall market conditions and industry trends if they affect the business’s loan servicing ability. The lenders are more inclined to approve a loan if the concerned business registers growth or is part of a stable industry. Good economic conditions and a strong business plan can really help in attracting funding.

Collateral is any business property, equipment, or inventory that the borrower provides as security against such loans. In case of failure of repayment of the loan, this can be seized by the lender to offset the incurred loss. Collateral is very important for borrowers with poor credit history and thus creates an alternative option for the lender.

The five C’s of credit are an integral part of credit analysis because it helps the lender understand the involved risk in lending money to a business. All five outline the condition of the borrower with regard to the character, financial condition, and capacity regarding repayment of loans.

Knowing the importance of credit, helps when applying for a business loan. The 5 C’s of credit are important in that they reveal what is strong and what is weak. For example, when someone borrowing money has a high credit score with good capital investment, but works in an uncertain industry, the credit analysis may pay attention to the conditions. By looking at these factors, lenders can make smarter choices, and borrowers can adjust their loan applications to fit.

This importance of 5 C’s of credit in business increases the chances of obtaining a loan by examining each part, from maintaining a good credit history to ensuring enough capital investment.

Improving your financial situation and understanding how lenders view applicants are the best ways of increasing your possibilities of approval for credit. To get the best funding, it is quintessential to know the importance of credit and how to get it approved. Here are some key tips for you to improve:

Your credit history is very important when it comes to the sanctioning of credit. The creditors will especially scrutinize how well you have repaid your debt, your credit score, and any bad impression such as missed payments or defaults. Improvement in this can be brought about by ensuring timely bill payments, avoiding missed payments, and low debt equity. A good credit history indicates to the lenders that you are responsible, which helps them grant easy approval to your applications.

High debts can give you bad credit rate. Your lenders will assess your debt-to-income ratio in comparison to your ability to manage more debts. Try reducing your outstanding debts before any new credit. This will make you financially healthy and increase your chance of getting the loan.

One more way to improve your chances is showing the capacity to pay back the loan. Whether you apply for personal lending or business credit, one thing all lenders check for is that you receive sufficient total income or cash flow so that timely payments can be made. For a business, stable and good cash flow indicates financial soundness, while a higher income will make an individual look better in the eyes of a lender.

By investing your money into the business, you can prove to lenders that you have something to lose if your business fails. As long as your money is on board, the risk to the lender goes down, which increases the chance of them accepting your application. Credit evaluations come in very key when proving your commitment by investing your own money.

Collateral can help your chance of approval. It is because collateral minimizes the risk involved with lenders. They can seize the item that you are offering in case of a failure to meet your end of the bargain. Property, vehicles, machinery, and equipment can be used as collateral for the loan, hence bestowing better terms like lowered interest rates and extended repayment periods.

Know the loan conditions you are applying for, like interest rates, terms, and repayment schedules. Making sure they fit your financial situation can improve one’s chances for approval. One must apply for only a loan that they are sure to pay, as lenders critically put this at the topmost consideration on whether to approve one’s loan.

When businesses understand 5’Cs of credit, then they can prepare themselves better when approaching business loan requests. Good credit history, depiction of the ability to pay back money, infusion of money into the capital, and collateral can help in the approval of loans and maintain the stability of finances for longer. Knowing why credit is important, and looking at these factors, allows business to know how to receive money needed to grow and prosper.

Character is important because it reflects the borrower’s trustworthiness and repayment history. Lenders evaluate the borrower’s credit history, past loan management, and overall reputation. A good character reassures lenders that the borrower is responsible and likely to repay the loan on time.

Collateral is the security on behalf of the lender. This can be an asset that could be taken away from the borrower if he/she fails to return the amount lent to him/her. It makes the risk of the lender lower, thereby sometimes offering better loan terms, such as offering loans at low interest rates or for longer periods of time.

Conditions refer to economic factors, market trends, and loan specifications such as interest rates and the purpose of the business loan. The lender would consider these while understanding the external risks for the borrower’s repayment ability. Better conditions will increase the likelihood of being approved for a loan.

Character, capacity, capital, conditions, and collateral are the five Cs involved in loan approval. These help lending staff to evaluate the borrower trustworthiness and ability to repay the loan and provide a non-discriminatory decision regarding approval of the loan.